Why This Matters

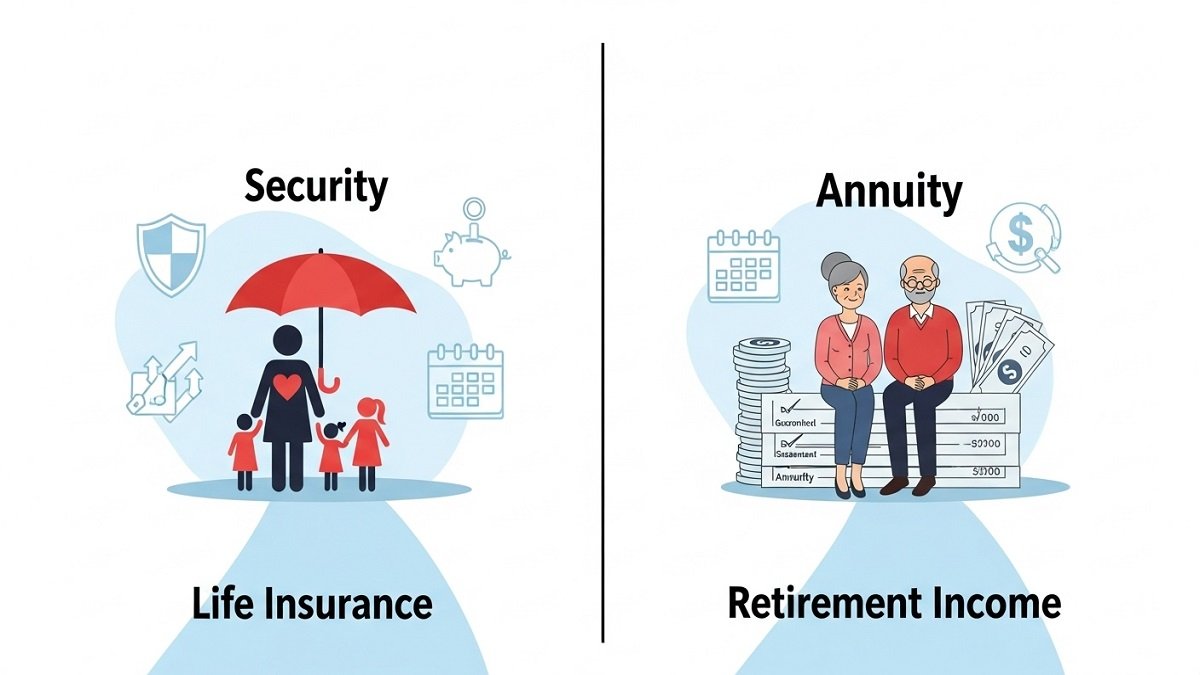

Planning for the future isn’t just about saving — it’s about protecting your family and ensuring you’ll have income when you need it most. Two of the most common tools offered by insurance companies are life insurance and annuities. They sound similar, but they serve very different purposes:

- Life insurance protects your loved ones after you’re gone.

- Annuities provide you with income during retirement.

Here’s how each works, what to know about taxes, risks, and how to decide which product fits your situation.

How Life Insurance Works

Life insurance is essentially a contract: you pay regular premiums, and when you pass away, your beneficiaries receive a lump-sum payout. That payout can replace lost income, cover bills, or help pay down debts like a mortgage.

Common Types of Life Insurance

- Term Life Insurance – Coverage lasts for a set period (10, 20, or 30 years). It’s affordable but temporary. If you die within the term, your family collects the death benefit. Renewals cost more as you age.

- Permanent Life Insurance – Coverage lasts your entire life and includes a cash value component that builds over time. There are several versions:

- Whole Life: Guaranteed coverage with fixed premiums.

- Universal Life: More flexible, letting you adjust payments or death benefits.

- Variable Life: Lets you invest the cash value in markets for higher growth potential — and higher risk.

When it makes sense: If you’re young, have a family depending on your income, or carry large debts like a mortgage, life insurance is an essential safeguard.

How Annuities Work

An annuity is the opposite: instead of protecting your family when you die, it protects you while you’re alive. You give the insurance company money — either in a lump sum or over time — and in return you receive guaranteed income later, usually in retirement.

Annuities by Timing

- Immediate Annuities – You pay a lump sum and start receiving income right away (within 12 months).

- Deferred Annuities – You invest money now, it grows tax-deferred, and payments begin later (often at retirement).

Annuities by Growth Style

- Fixed Annuity – Pays a guaranteed interest rate with steady income. Low risk, low reward.

- Variable Annuity – Invests in market assets like mutual funds. High upside, but losses are possible.

- Indexed Annuity – Returns are tied to a stock index (like the S&P 500) with a guaranteed minimum. Balanced risk and reward.

When it makes sense: If you’re near retirement and want a steady paycheck to supplement Social Security or pensions, an annuity can provide peace of mind.

Taxes: Life Insurance vs. AnnuitieS

- Life Insurance: Death benefits are tax-free to your beneficiaries. Any cash value inside a permanent policy grows tax-deferred, but withdrawals above what you’ve paid in premiums can be taxable.

- Annuities: Money grows tax-deferred, but when you start taking withdrawals, they’re taxed as regular income. Contributions are not tax-deductible.

Risks to Consider

- Life Insurance Risks:

- Term life ends after the policy period — if you outlive it, there’s no payout.

- Permanent life is costly; if you stop paying, you could lose coverage.

- Annuity Risks:

- Limited liquidity — your money is locked in, and early withdrawals come with penalties.

- Fees can be high and eat into returns.

- Variable and indexed annuities carry market risk, so payouts may fluctuate.

Choosing the Right Option

Ask yourself:

- Do I need to protect my family from financial loss if I die? → Life insurance.

- Do I want guaranteed retirement income for myself? → Annuity.

Practical Scenarios

- Young family, new mortgage: A 30-year-old couple with kids should prioritize permanent life insurance to protect dependents.

- Near retirement, steady savings: A 60-year-old who wants extra monthly income alongside Social Security may benefit from a fixed or immediate annuity.

The Bottom Line

Life insurance and annuities aren’t interchangeable — they solve different problems. Life insurance is about protecting the people you leave behind, while annuities are about ensuring you don’t outlive your savings.

If you’re unsure which makes sense for you, talk with a licensed financial advisor who understands both products and can tailor a plan to your needs.