Interest Rates After the Latest Fed Meeting: What Changes for Your Wallet?

The Federal Reserve has just concluded its January 2026 policy meeting. While these meetings can feel like they are meant only for Wall Street, the decisions made directly impact your monthly bills, your debt, and your future savings.

Here is the “real world” breakdown of the latest decision and what you should do next.

1. The Big Decision: The Fed Hits “Pause”

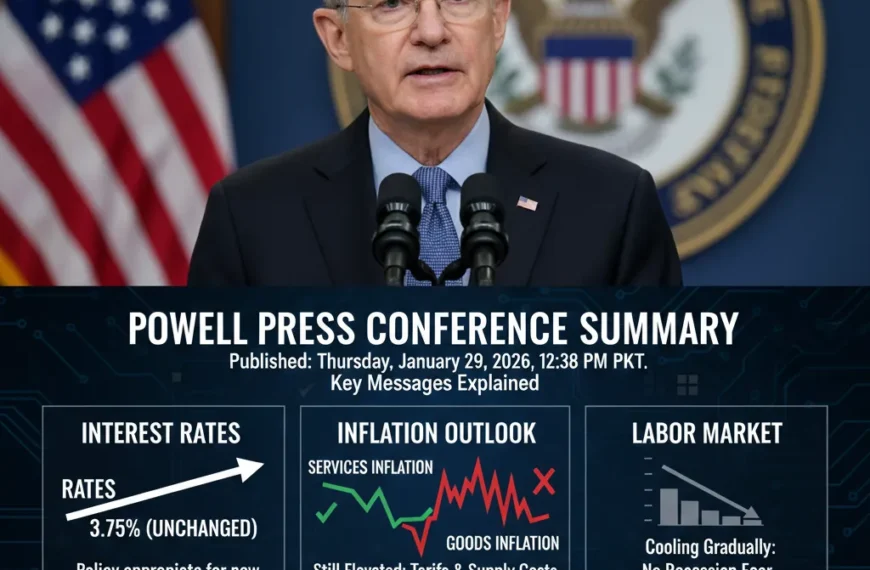

Following three consecutive rate cuts in late 2025, the Federal Reserve has decided to keep interest rates unchanged at a target range of 3.50% to 3.75%.

Why the hold?

Fed Chair Jerome Powell emphasized a “wait-and-see” approach. With the economy growing at a healthy 2.3% and the labor market remaining resilient, the Fed wants to ensure inflation (currently around 2.7%) continues its slow descent toward the 2% target before cutting rates further.

2. At-a-Glance: How the Fed Decision Hits Your Pocket

Use this table to quickly see how your specific financial goals are affected by the current “Rate Hold.”

| Financial Category | Current Trend | Recommendation |

| 30-Year Mortgages | Hovering between 6.0% – 6.3% | Don’t wait for 3%. If you find a home, consider a 5/1 ARM or a rate buy-down. |

| High-Yield Savings | Excellent yields (4.0% – 5.0%) | Keep your emergency fund here; these are peak “safe” returns for 2026. |

| Auto Loans | High (7.5% – 11% average) | Shop local credit unions; they are currently beating dealership rates. |

| Credit Card APRs | Record Highs (21% – 25%) | Priority #1: Pay these off. A “hold” means your debt isn’t getting cheaper. |

| CDs (Certificates) | Slightly dipping | Lock in a 12-month CD now before the Fed cuts rates later this year. |

3. Mortgages: The New “Normal” for 2026

Homebuyers hoping for a return to 3% mortgage rates may be disappointed. Because the Fed held rates steady, the 10-year Treasury yield (which mortgages follow) has remained stable.

- The Reality: Most experts expect mortgage rates to drift only slightly lower toward 6.0% by mid-2026.

- The Strategy: If you are looking to buy, focus on the property rather than the perfect rate. Refinancing remains an option if the Fed resumes cuts in the second half of the year.

4. Savings: The “Golden Era” Continues

If you have cash sitting in a traditional big-bank savings account earning 0.01%, you are missing out.

- The Opportunity: Online banks are maintaining aggressive rates to attract deposits. With the Fed on hold, you can still find High-Yield Savings Accounts (HYSAs) paying over 4.5%.

- Action Item: If you have extra cash, consider a “Ladder” of 6-month and 12-month CDs to lock in today’s high yields before they begin to fade.

5. Credit Cards and Loans: No Relief Yet

Because the Fed didn’t cut rates, the “Prime Rate”—which determines your credit card interest—will stay exactly where it is.

- The Warning: If you are carrying a balance, you are likely losing a significant amount of money to interest every month.

- The Solution: Explore 0% APR balance transfer cards or personal loans to consolidate high-interest debt while the Fed remains in this holding pattern.

6. What’s Next? (The 2026 Outlook)

The market is currently pricing in a 95% chance that rates stay the same through the next meeting. However, economists are watching two main triggers for a potential cut in March or June:

- Inflation dipping below 2.5%

- The Unemployment rate rising above 4.5%

Until one of those happens, “higher for longer” remains the theme of the year.