While consumers grapple with record credit card debt, the business sector is showing surprising resilience in its borrowing habits. According to the Federal Reserve’s H.8 statistical release for January 2026, Commercial and Industrial (C&I) loans have continued a steady climb, signaling that American businesses are still investing in growth despite a “higher-for-longer” interest rate environment .

This trend suggests that the corporate sector is successfully navigating the current economic climate, contrasting sharply with the financial strain felt by many households.

A Steady Climb in Business Credit

The latest data confirms the robust demand for business credit. As of the week ending January 14, 2026, total Commercial and Industrial loans at all commercial banks reached $2,733.8 billion ($2.73 trillion). This represents a notable increase from the $2,698.6 billion recorded in December 2025, underscoring a strong start to the new year.

The annual and quarterly growth figures for 2025 further illustrate this momentum:

•Annual Growth: C&I loans grew at an annual rate of 4.3% in 2025.

•Quarterly Momentum: The growth was particularly strong in the third quarter of 2025, hitting a 7.9% annual rate before moderating to 3.0% in the final quarter.

This sustained borrowing activity, even with interest rates at multi-year highs, indicates that businesses perceive sufficient return on investment to justify the increased cost of capital.

Large vs. Small Bank Lending

The data reveals a slight divergence in where businesses are securing their funding, with large, domestically chartered banks holding the majority of the credit. The breakdown of the $2.73 trillion total is as follows:

| Lending Institution | C&I Loans (Billions) | Percentage of Total |

| Large Domestically Chartered Banks | $1,436.7 | 52.6% |

| Small Domestically Chartered Banks | $738.1 | 27.0% |

| Foreign-Related Institutions | $559.0 | 20.4% |

| Total | $2,733.8 | 100.0% |

The $1,436.7 billion held by the top 25 domestically chartered banks highlights their central role in financing the corporate sector, with their holdings rising from $1,424.7 billion in December. Meanwhile, regional and community banks (Small Banks) continue to play a significant role, holding $738.1 billion in business loans.

Lending Conditions and Market Sentiment

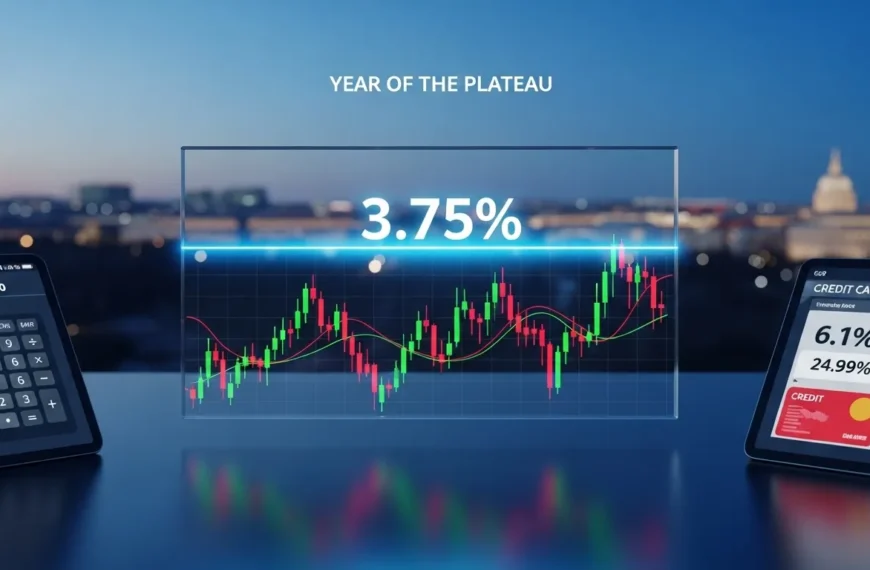

The uptick in C&I lending is significant because it occurred during a period where interest rates remained elevated. Traditionally, high rates cool business borrowing; however, the data suggests that corporations are either refinancing existing debt or taking on new capital to fund operations that they expect will outpace the cost of borrowing.

Furthermore, the blog post notes a surge in lending to nondepository financial institutions (like private equity and hedge funds), which hit $1,846.0 billion in mid-January. This indicates high liquidity needs across the broader financial ecosystem, suggesting active capital deployment and a strong appetite for risk among financial intermediaries.

The FinexNews Outlook

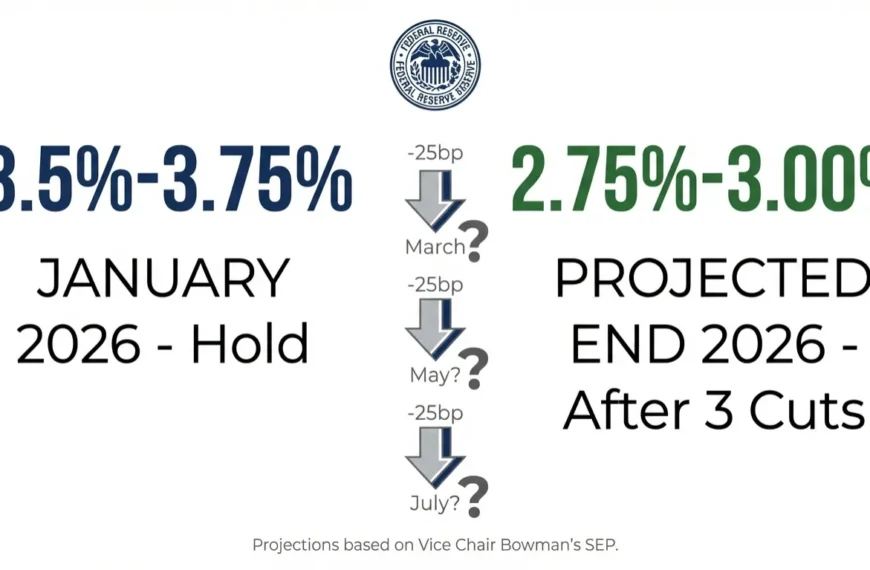

The fact that C&I loans are edging higher suggests that the “hard landing” some economists feared for the business sector has yet to materialize. The moderation in growth during the fourth quarter of 2025, followed by the January uptick, may reflect a period of adjustment as businesses recalibrate their investment strategies in anticipation of the Federal Reserve’s expected rate cuts later in 2026.

As we move further into 2026, the critical question for the economy is whether this borrowing is being used for productive expansion—such as capital expenditures and hiring—or simply to bridge the gap in a high-inflation environment. The answer will determine the long-term health and trajectory of the U.S. corporate sector.