The U.S. Federal Reserve is widely expected to pause interest rate cuts at its first policy meeting of 2026 this week. However, the financial world’s attention has shifted away from the federal funds rate and toward the intensifying legal and political pressure facing Chair Jerome Powell.

Wednesday’s post-meeting press conference will mark Powell’s first public appearance since disclosing earlier this month that he is under a criminal investigation by the Justice Department. For many investors, the central question is no longer about the “dot plot,” but rather the future of the central bank’s independence.

The Investigation: Perjury Allegations or Political Pretext?

The investigation, approved by U.S. Attorney Jeanine Pirro, centers on allegations that Powell committed perjury during a June 2025 Senate hearing regarding the $2.5 billion renovation of the Federal Reserve’s headquarters. Critics have pointed to cost overruns that ballooned from an initial $1.9 billion as evidence of mismanagement.

Powell has dismissed the probe as a “pretext” designed to intimidate the central bank into lowering interest rates.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what serves the public, rather than following the preferences of the President,” Powell stated in a recent video release.

A Divided Central Bank Under Siege

The pressure is not limited to Powell. The executive branch is also currently engaged in a Supreme Court battle (Trump v. Cook) to remove Fed Governor Lisa Cook over alleged mortgage filing discrepancies. Powell’s public appearance at the Supreme Court oral arguments on January 21 was seen by many as a silent show of solidarity against executive interference.

“I’m not expecting any big changes in policy,” says Michael Pearce, Chief U.S. Economist at Oxford Economics. “The most important questions will focus on the investigation and how Powell responds to it.”

Economic Data Supports a Rate Pause

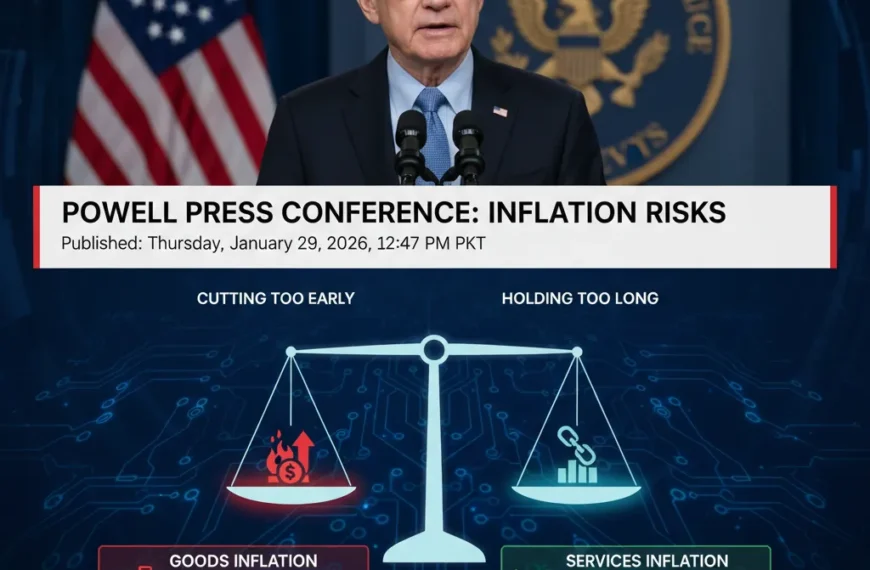

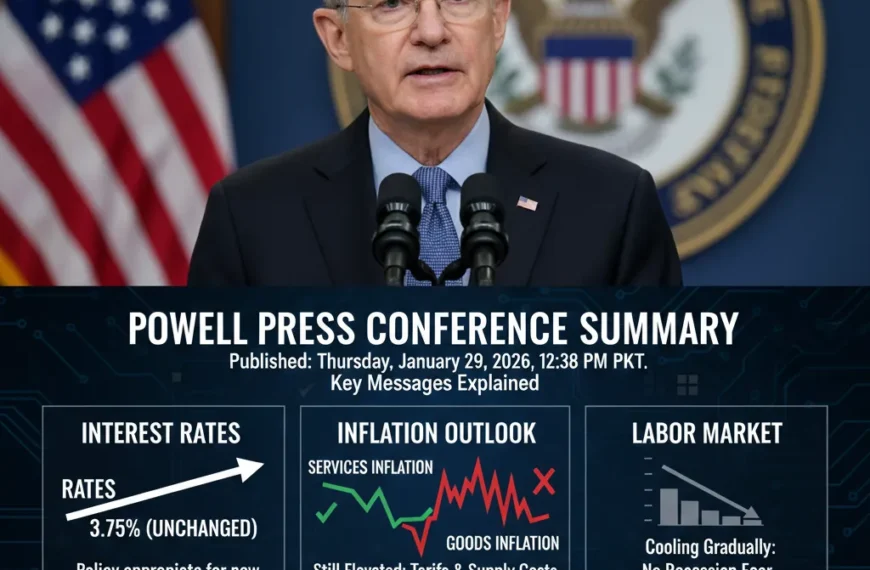

Despite the noise in Washington, the Fed’s economic “dual mandate” suggests a cautious approach is warranted. Recent data indicates:

- Inflation: Remains above the 2.0% target, with the annual PCE rate creeping up to 2.8%.

- Labor Market: Unemployment has stabilized around 4.5%, reducing the urgency for the “emergency” cuts seen in late 2025.

- Current Rates: The federal funds rate sits at approximately 3.64%, which many officials view as “neutral.”

What to Watch at Wednesday’s Press Conference

With the Fed expected to hold rates steady, the markets will be laser-focused on:

- Powell’s Demeanor: Will he remain defiant regarding the DOJ probe?

- Independence Rhetoric: Any shift in how the Fed describes its ability to act without “fear or favor.”

- Forward Guidance: Whether the Fed still envisions the two rate cuts for 2026 that major firms like Goldman Sachs have predicted.

The January 2026 Fed meeting may go down in history not for its economic impact, but for its role in a constitutional tug-of-war. While the economy appears to be finding a “soft landing,” the institutional framework of the Federal Reserve is facing its most significant test since its founding in 1913.