Fed Holds Rates Steady at 3.5% to 3.75%: Full FOMC Decision Summary

The Federal Reserve left interest rates unchanged at its latest policy meeting, keeping the federal funds rate in a range of 3.5% to 3.75%.

The decision reflects the Fed’s growing confidence that inflation is easing, but also its caution about cutting rates too early. Policymakers made clear that future moves will depend on incoming data, not a preset path.

What the Fed Decided

At the conclusion of the meeting, the Federal Open Market Committee voted to maintain current interest rates.

Key points from the decision:

- No rate hike or rate cut

- Policy remains restrictive

- Officials believe current rates are close to neutral

- Future decisions will be made meeting by meeting

The Fed has already lowered rates by 75 basis points over the last three meetings and now appears comfortable pausing.

Why the Fed Chose to Hold Rates

The Fed cited a mixed economic picture.

Inflation has fallen sharply from its 2022 highs but remains above the Fed’s 2 percent target. At the same time, job growth has slowed, and the labor market is no longer overheating.

Officials said:

- Consumer spending remains resilient

- Business investment continues to grow

- Housing activity is still weak

- Job gains have slowed, but unemployment is stable

This balance supports patience rather than immediate action.

Inflation Update From the Fed

Inflation remains the central concern.

According to the Fed:

- Headline PCE inflation is near 2.9%

- Core PCE inflation is around 3.0%

- Goods inflation is being pushed up by tariffs

- Services inflation continues to cool

The Fed said inflation expectations remain well anchored, which gives policymakers room to wait.

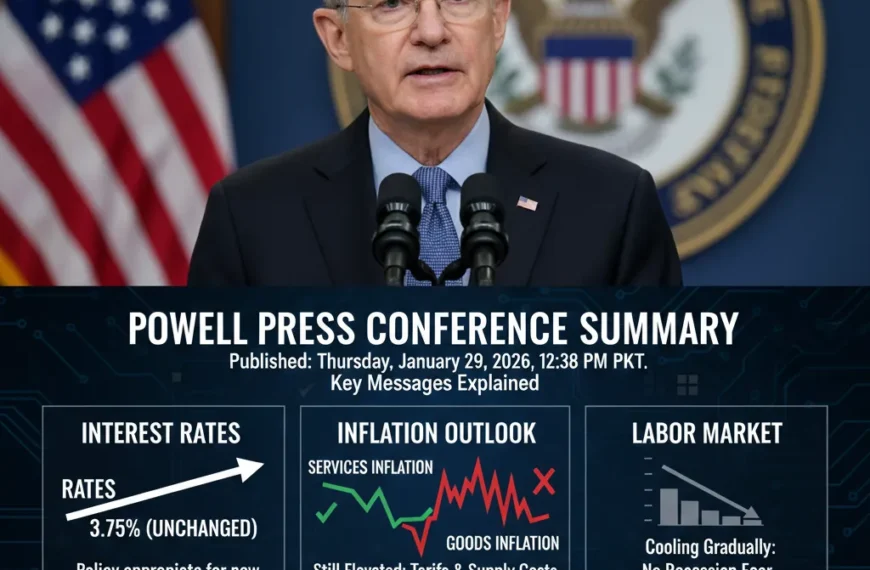

What Powell Said in the Press Conference

Fed Chair Jerome Powell emphasized caution and flexibility.

Powell made it clear that:

- Monetary policy is not on a preset course

- The Fed needs more evidence before adjusting rates

- Cutting rates too soon could risk inflation returning

- Keeping policy restrictive for too long also carries risks

His tone was calm and data focused, signaling neither urgency nor complacency.

What the Decision Signals for Future Rate Cuts

Markets were looking for hints about what comes next, and the message was measured.

The Fed did not commit to a timeline for rate cuts. Instead, officials stressed that future moves will depend on:

- Inflation trends

- Labor market conditions

- Overall economic growth

This suggests rate cuts remain possible later, but not guaranteed.

Market Reaction in Brief

Markets reacted with limited volatility following the announcement.

Investors appeared to accept the Fed’s message that:

- Policy is near neutral

- Inflation progress is real but incomplete

- Patience is the current strategy

Bond yields and the dollar moved modestly as traders adjusted expectations rather than reacting to a surprise.

What to Watch Next

After this meeting, attention shifts back to economic data.

Key reports to watch:

- Inflation readings

- Jobs and unemployment data

- Consumer spending figures

These releases will shape expectations for the next FOMC meeting.

Final Takeaway

The Fed’s decision to hold rates steady shows confidence in progress on inflation, but not enough to declare victory.

For now, the message is simple:

Wait, watch the data, and stay flexible.

Markets should expect fewer surprises and more careful signaling in the months ahead.