FOMC Meeting Highlights: Why the Fed Stayed on Hold

The Federal Open Market Committee decided to keep interest rates unchanged at its latest meeting, signaling patience as inflation continues to cool but remains above target.

The decision reflects a careful balance. The Fed sees progress, but not enough to justify further rate cuts yet.

Below are the key reasons behind the hold decision and what it tells us about future policy.

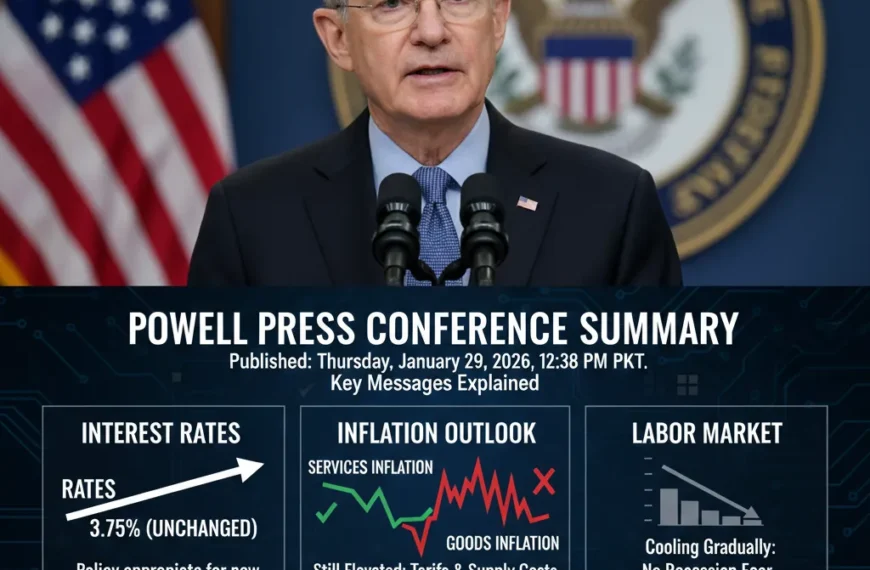

The Rate Decision at a Glance

The Federal Reserve kept the federal funds rate in a range of 3.5% to 3.75%, following rate cuts earlier in the policy cycle.

Officials emphasized that monetary policy is now close to neutral and well positioned to respond to future data.

Why the Fed Stayed on Hold

The Fed pointed to several factors that support waiting rather than acting.

1. Inflation Is Lower, but Not Low Enough

Inflation has eased significantly since 2022, but core measures remain above the Fed’s 2 percent goal. Policymakers want stronger confirmation before adjusting rates again.

2. The Labor Market Is Cooling Gradually

Job growth has slowed, and unemployment remains stable. This suggests the economy is adjusting without major stress.

3. The Economy Is Still Expanding

Consumer spending and business investment continue to support growth, even as housing remains weak.

4. Risks Are More Balanced

The Fed no longer sees extreme upside or downside risks, which supports a wait-and-see approach.

Key Highlights From the Meeting:

| Area | What the Fed Said | What It Means |

|---|---|---|

| Interest Rates | Rates left unchanged | Policy pause continues |

| Inflation | Still above target | Cuts not urgent |

| Labor Market | Slowing but stable | No recession signal |

| Economic Growth | Expanding at a solid pace | Economy holding up |

| Policy Path | No preset course | Data decides next move |

| Inflation Risks | Goods inflation elevated | Tariffs still matter |

What Powell Made Clear

Fed Chair Jerome Powell reinforced the message of patience during the press conference.

His main points:

- The Fed is not in a hurry to cut rates

- Policy decisions will be made meeting by meeting

- Cutting too early could risk inflation returning

- Holding rates too long also carries risks

Powell’s tone was calm and measured, which markets interpreted as steady rather than restrictive.

What This Means for Future Rate Moves

The Fed did not rule out future rate cuts, but it also did not promise them.

Future decisions will depend on:

- Inflation trends

- Jobs and wage growth

- Broader economic conditions

This suggests the next move could take time and will be driven by data, not market pressure.

Market Takeaway

Markets reacted calmly to the decision, indicating that the rate hold was largely expected.

Investors now see the Fed as:

- Comfortable with current policy

- Focused on inflation data

- Willing to wait for clearer signals

Volatility may increase again when fresh inflation or jobs data is released.

Final Summary

The Fed stayed on hold because the economy is slowing in an orderly way and inflation progress, while real, is not complete.

For now, the message is steady and clear:

No rush. No panic. Watch the data.