The numbers don’t lie, but they sure know how to hide in plain sight.

While headlines trumpeted a “resilient economy” throughout 2025, a different story was unfolding in America’s job market—one that Federal Reserve Governor Christopher Waller just pulled into the spotlight with uncommon bluntness.

In a rare dissent at the Fed’s latest policy meeting, Waller dropped a statistic that should make every working American sit up and pay attention: The U.S. economy added virtually zero net jobs in 2025.

Not a slowdown. Not a soft patch. Zero.

As Waller put it in his January 30th statement: “Zero. Zip. Nada.”

The Decade-Long Comparison That Changes Everything

To understand just how alarming this is, you need context.

For the ten years leading up to 2025, the American economy created an average of 1.9 million jobs annually. That’s the baseline—the expected rhythm of a functioning labor market in the world’s largest economy.

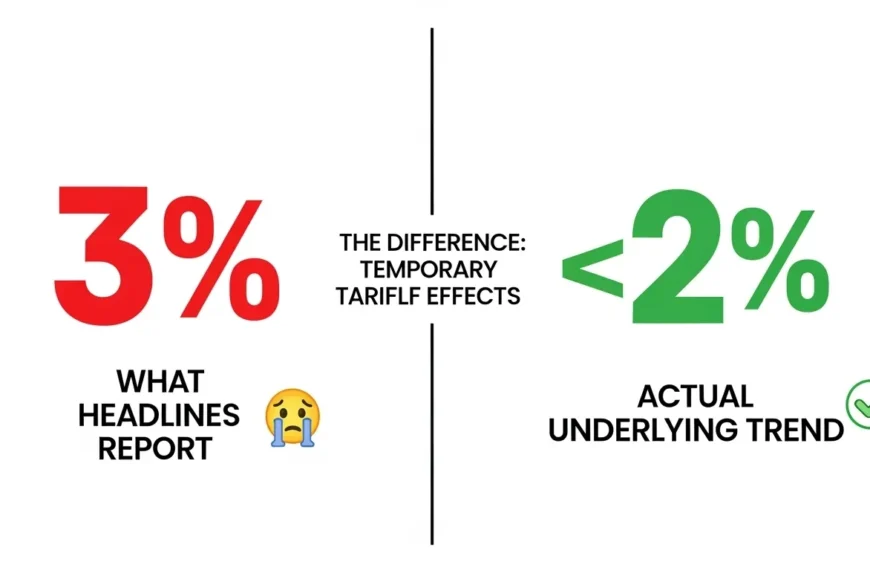

In 2025, payrolls increased by just under 600,000 jobs. Bad enough on its own, right?

But here’s the kicker: Waller noted that upcoming revisions to the data will likely show that actual job growth was “virtually zero” once the numbers are properly adjusted.

Think about that. Nearly two million jobs created per year for a decade. Then suddenly, nothing.

This isn’t a statistical blip. This is a fundamental shift in how businesses are thinking about their workforce.

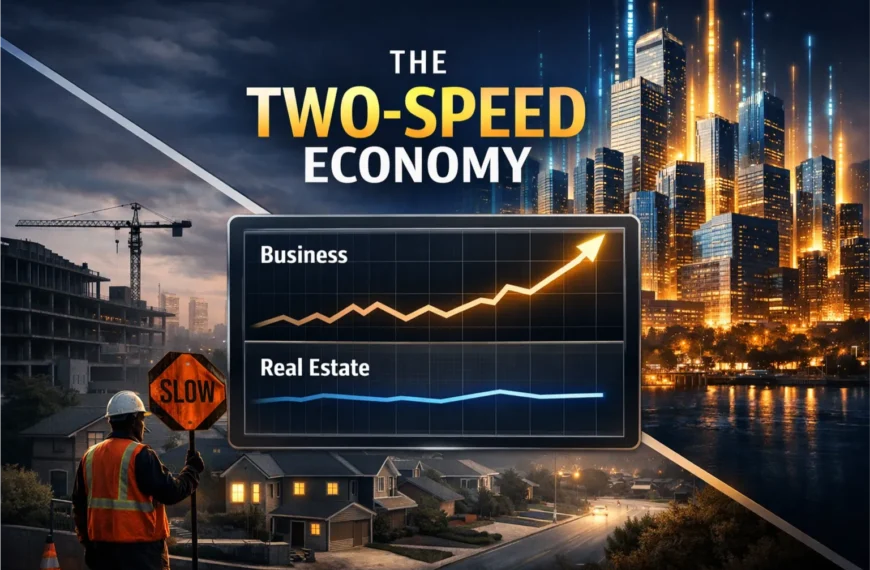

The Strange Paradox: Growth Without Jobs

Here’s where it gets confusing for most people watching the news.

GDP growth has remained solid. Corporate earnings haven’t collapsed. The stock market hasn’t crashed. By traditional measures, the economy looks… fine?

So why aren’t companies hiring?

The answer reveals something uncomfortable about the current moment: businesses are deeply uncertain about what comes next.

Governor Waller’s statement points to what he’s been hearing directly from employers in Fed outreach meetings: companies are planning layoffs for 2026. Not because they’re failing right now, but because they don’t trust that current conditions will hold.

This is what economists call a “wait and see” posture, but for workers, it translates into something much more concrete: employers are reluctant to fire people, but they’re even more reluctant to hire.

If you’ve been job hunting recently, you’ve probably felt this. Applications disappear into black holes. “We’ve decided to pause hiring for this role” becomes the standard rejection. Positions get reposted month after month without anyone actually getting hired.

You’re not imagining it. The data backs up what you’re experiencing.

What’s Really Driving the Hiring Freeze?

Several factors are colliding to create this employment ice age:

Uncertainty about policy direction. With new tariffs, potential regulatory changes, and shifting trade relationships, many companies genuinely don’t know what their cost structure will look like six months from now. Hiring is a commitment—and commitments feel dangerous when you can’t see around the corner.

Technology’s double-edged sword. Automation and AI aren’t just theoretical anymore. Companies that might have hired three people for a project two years ago are now testing whether two people plus software can get it done. They’re not announcing this in press releases, but it’s happening in budget meetings across every industry.

The “do more with less” mentality has become permanent. COVID forced companies to operate with skeleton crews. Many discovered they could maintain output with fewer people than they thought possible. That realization hasn’t gone away just because the pandemic has.

Labor supply constraints. Lower immigration, earlier retirements, and demographic shifts mean there are simply fewer workers available. But instead of bidding up wages to compete for talent (which would show up as wage growth), many companies are just… not filling positions.

The Unemployment Rate Illusion

You might be wondering: if job growth is zero, why isn’t unemployment skyrocketing?

Good question. The unemployment rate has risen since mid-2025, but not dramatically. It even ticked down in the most recent reading.

But that statistic only counts people actively looking for work. It doesn’t capture:

- People who’ve given up searching after months of rejections

- Recent graduates who’ve delayed entering the job market

- Workers who retired earlier than planned because opportunities dried up

- People who’ve shifted to gig work or underemployment but aren’t counted as “unemployed”

The unemployment rate is like checking your temperature when you have the flu—it tells you something, but it doesn’t tell you everything.

What This Means If You’re Looking for Work Right Now

Let’s get practical. If you’re job hunting in this environment, here’s what you need to know:

The game has changed, and speed matters less than strategy. Spray-and-pray applications aren’t working. Companies hiring in this market are being extremely selective. You need to tailor your approach, demonstrate clear value, and show you understand their specific challenges.

Internal mobility might be your best bet. If you’re currently employed, transferring within your organization is often easier than jumping ship. Internal candidates already understand company culture, don’t require onboarding, and feel like a safer bet to risk-averse managers.

Skills that reduce costs or uncertainty are gold. If you can credibly claim you’ll make processes more efficient, reduce vendor dependency, or navigate regulatory complexity, you’re speaking the language employers want to hear right now.

Contract and project-based work is expanding. Companies don’t want to commit to permanent headcount, but they still have work that needs doing. Freelance, consulting, and contract positions are becoming a larger share of available opportunities.

Your network isn’t optional anymore. When companies are barely posting jobs publicly, referrals and direct connections become the primary hiring channel. If you’ve been coasting on your resume alone, that won’t cut it anymore.

For Those Currently Employed: Read the Room

If you have a job right now, Waller’s warning about planned layoffs in 2026 deserves attention.

This doesn’t mean panic or paranoia, but it does mean awareness.

Watch your company’s hiring patterns. If open positions aren’t getting filled, if teams are being asked to “make do,” if there’s growing talk about efficiency—these are signals that belt-tightening is underway.

Document your impact. In a stable market, your work speaks for itself. In an uncertain market, you need to be able to articulate your specific contributions clearly. If layoffs come, decisions get made quickly, and visibility matters.

Build your runway. Emergency funds aren’t exciting, but three to six months of expenses in savings could be the difference between weathering a job search calmly and taking the first desperate offer that comes along.

Keep your skills current. The worst time to realize you need new capabilities is when you’re suddenly competing with hundreds of other applicants for every opening.

The Career Changers’ Dilemma

Perhaps no group faces a tougher challenge in this environment than people trying to switch careers.

When companies are barely hiring for roles where candidates have direct experience, they’re certainly not taking chances on career pivoters—no matter how compelling the narrative.

If you’re in this boat, the path forward requires patience and creativity:

Build proof before you ask for opportunity. Side projects, volunteer work, certifications, portfolio pieces—anything that demonstrates competence in your target field without requiring someone to bet their hiring budget on you.

Look for hybrid roles. Positions that blend your existing expertise with new skills you want to develop give you a more credible story than a complete 180-degree turn.

Consider stepping down (strategically). Sometimes accepting a more junior role in your target field makes sense if it gets you in the door and positioned for growth when the market loosens up. It’s not ideal, but it beats being stuck in a holding pattern indefinitely.

What Comes Next?

Governor Waller dissented because he believes the Fed should be cutting interest rates more aggressively to support the labor market. His view: monetary policy is still too restrictive given how weak employment has become.

Whether the Fed follows his advice remains to be seen. But his dissent signals that the employment situation is serious enough that at least some policymakers are worried about a substantial deterioration ahead.

For workers, the message is clear: the labor market isn’t just cooling—it’s fundamentally different than it was a year ago.

The good news? Labor markets are cyclical. Hiring will eventually pick back up. The companies sitting on the sidelines now will need talent when conditions stabilize.

The challenge? Nobody knows when that turning point arrives.

In the meantime, the best strategy isn’t to wait for the market to improve—it’s to position yourself as well as possible for whenever that shift happens.

Because when hiring does resume, the opportunities will go to people who stayed ready, stayed visible, and stayed realistic about what this strange moment actually requires.

The employment crisis might be hiding in plain sight, but now you know where to look.

What’s your experience in the job market right now? Are you seeing the hiring freeze Waller describes, or does it vary by industry? Share your perspective in the comments below.