The Federal Reserve just wrapped up its January meeting, and the decision was exactly what markets expected: rates stay put. But the real story isn’t what happened this week—it’s what Vice Chair Michelle Bowman is planning for the rest of the year.

And if her projections are right, your borrowing costs are about to get a lot cheaper.

The January Decision: A Strategic Pause

Let’s start with what just happened. The FOMC voted unanimously to hold the federal funds rate at 3.5% to 3.75%. No surprises there. But Bowman’s explanation for supporting this decision reveals the thinking behind what comes next.

She described the choice as essentially a timing question: move faster toward neutral rates by April, or take a more measured approach throughout the year?

“After lowering the policy rate by a total of 75 basis points in the latter part of last year,” Bowman explained, “we can afford to take time and ‘keep policy powder dry’ for a little while.”

Translation? The Fed already cut rates three times in late 2025. Now they’re taking a breath to see how those cuts are working their way through the economy.

Three Cuts Coming: Here’s the Breakdown

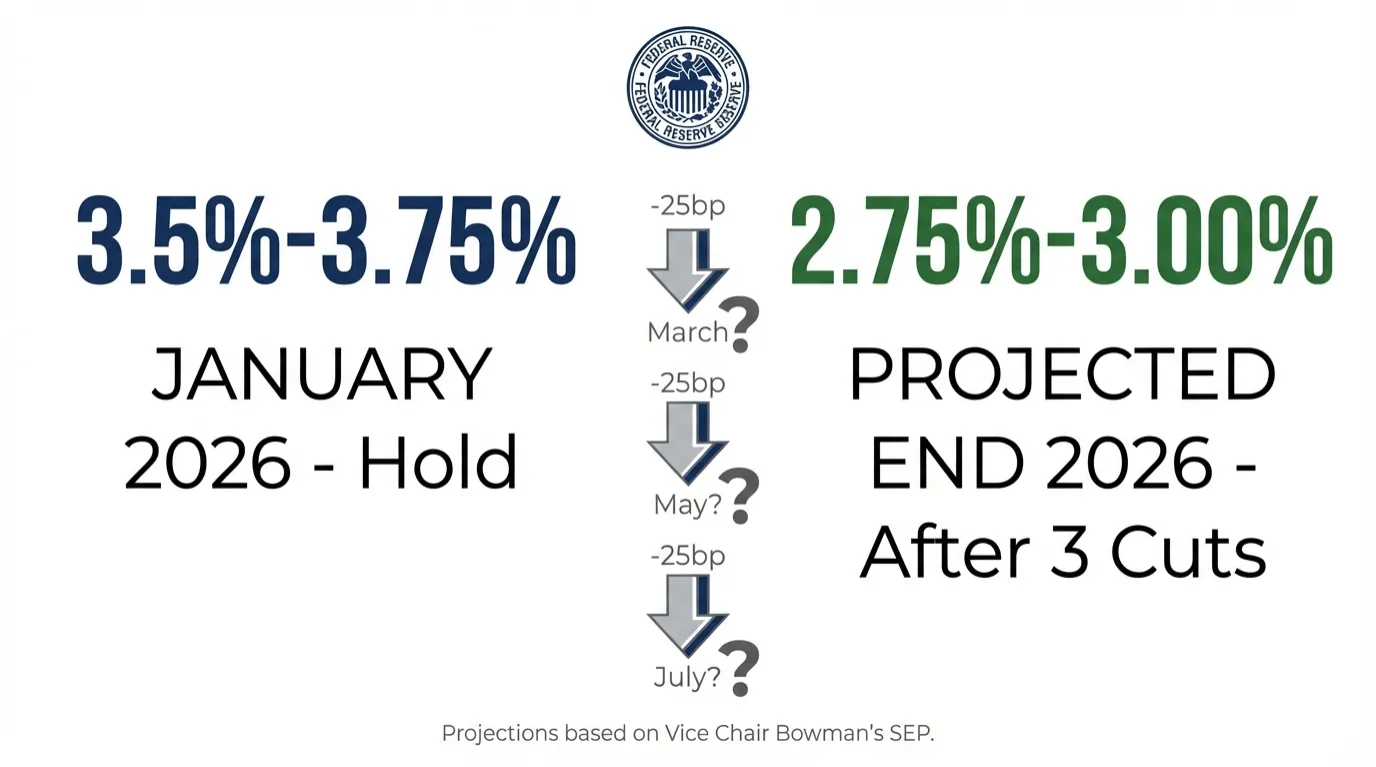

Despite the pause, Bowman’s Summary of Economic Projections (SEP) includes three rate cuts for 2026. That’s her personal forecast, not a commitment from the entire FOMC, but it signals where she thinks policy needs to go.

Let’s break down what that could look like:

| Scenario | Current Rate | After 3 Cuts | Basis Point Reduction |

|---|---|---|---|

| Conservative (25bp each) | 3.50% – 3.75% | 2.75% – 3.00% | 75 basis points |

| Moderate (mixed cuts) | 3.50% – 3.75% | 2.50% – 2.75% | 100 basis points |

| Aggressive (larger cuts) | 3.50% – 3.75% | 2.25% – 2.50% | 125 basis points |

Most Fed watchers expect the conservative scenario: three quarter-point cuts totaling 75 basis points. That would bring the federal funds rate down to somewhere between 2.75% and 3%.

The Path to Neutral

Bowman continues to view current policy as “moderately restrictive.” That’s Fed-speak for “rates are tight enough to slow things down.” The goal is to move toward a “neutral” rate—the level that neither stimulates nor restricts economic growth.

She mentioned she could have supported reaching her estimate of neutral by the April meeting. That tells us something important: neutral is probably around 2.75% to 3% in her view, which aligns with the three-cut scenario.

Here’s a possible timeline based on her comments:

| Meeting Date | Likely Action | Projected Rate Range |

|---|---|---|

| January 2026 | HOLD | 3.50% – 3.75% |

| March 2026 | Possible CUT (-25bp) | 3.25% – 3.50% |

| May 2026 | Likely CUT (-25bp) | 3.00% – 3.25% |

| June/July 2026 | Final CUT (-25bp) | 2.75% – 3.00% |

This isn’t set in stone. As Bowman repeatedly emphasized, “monetary policy is not on a preset course.” Each meeting brings new data and new decisions.

Why Wait Until March?

If Bowman thinks rates need to come down, why not cut now? She gave several reasons:

Data Quality Issues: The government shutdown created statistical noise in recent economic reports. She’s “reluctant to take meaningful signal” from data that might be unreliable.

Recent Progress: The Fed already cut 75 basis points in late 2025. Those cuts need time to flow through to broader financial conditions.

More Information Coming: By the March meeting, they’ll have two additional inflation reports and two more employment reports. Better to decide with clearer information.

“It was not a straightforward decision,” Bowman admitted. But ultimately, waiting for better data won out over acting immediately.

What This Means for Different Borrowers

Three rate cuts might not sound like much, but they add up. Here’s roughly what you could expect:

| Loan Type | Current APR | After 75bp Cuts | Monthly Savings* |

|---|---|---|---|

| 30-Year Mortgage ($400K) | 6.75% | ~6.00% | ~$175/month |

| Auto Loan ($35K, 5yr) | 7.50% | ~6.75% | ~$20/month |

| Credit Card | 21.00% | ~20.25% | Varies by balance |

| HELOC ($100K) | 8.75% | ~8.00% | ~$60/month |

*Approximate estimates; actual rates vary by lender and creditworthiness

Keep in mind that mortgage rates don’t move in lockstep with the federal funds rate. They’re more influenced by long-term Treasury yields, which factor in inflation expectations and economic growth forecasts.

The Labor Market Factor

Here’s something most coverage misses: Bowman’s rate cut projections aren’t really about inflation. They’re about jobs.

She was blunt about this: “I do not consider downside risks to the employment side of our mandate to have diminished, and I see several indications that the labor market remains vulnerable.”

The labor market concerns driving her projections include:

- Private payrolls growing at only 30,000 per month (well below the level needed to keep unemployment stable)

- Job availability index dropping to early 2021 lows

- Job gains concentrated almost entirely in healthcare

- Rising private sector layoff announcements

“With a less dynamic low-hiring, low-firing labor market,” she warned, “we could see layoffs rise quickly if firms begin to reassess their staffing needs.”

That’s why she’s planning three cuts even though inflation is still somewhat elevated. The bigger risk right now isn’t prices—it’s employment.

The Inflation Side of the Equation

Bowman isn’t ignoring inflation. She just sees it differently than the headlines suggest.

Her view: Core inflation is actually close to 2% once you strip out temporary tariff effects. The 3% headline number reflects distortions from tariffs and volatility in small categories like software and streaming services.

“The underlying trend in core PCE inflation appears to be moving much closer to our 2% target than is currently showing in the data,” she said.

That assessment gives her confidence to plan rate cuts without worrying about reigniting inflation. The trimmed-mean measures from Dallas and Cleveland Fed support this view—they show core inflation continuing to decline.

What Could Change the Plan

Remember that “not on a preset course” disclaimer? Here’s what could accelerate or delay those cuts:

Could Mean Faster Cuts:

- Sudden deterioration in labor market conditions

- Unemployment rate jumping significantly

- Wave of corporate layoffs

- Financial conditions tightening unexpectedly

Could Mean Slower Cuts:

- Clear and sustained improvement in hiring

- Inflation reaccelerating beyond seasonal patterns

- Economic growth proving stronger than expected

- Wage growth picking up meaningfully

Bowman made clear she won’t let first-quarter data volatility dictate decisions. “We should not rely on these data as a reason to delay policy action if we see a sudden and significant deterioration in labor market conditions.”

At the same time, she won’t panic if January inflation ticks up, which often happens due to seasonal factors.

Reading Between the Lines

The most revealing part of Bowman’s comments wasn’t about the cuts themselves. It was about urgency.

She pushed back against any suggestion the Fed would hold rates steady for an extended period: “We should also not imply that we expect to maintain the current stance of policy for an extended period of time because it would signal that we are not attentive to the risk that labor market conditions could deteriorate.”

That’s a strong statement. She’s essentially saying the bias is toward cutting, not holding. The question is when and how fast, not if.

She also warned against overconfidence about labor market stability: “History tells us that the labor market can appear to be stable right up until it isn’t.”

Translation? Don’t get complacent just because unemployment is currently at 4.4%. Things can turn quickly.

Bottom Line for 2026

Here’s what you need to know:

The Fed held rates this week, but Vice Chair Bowman is planning three cuts throughout 2026. If that plays out, we’re looking at rates falling from the current 3.5%-3.75% range to somewhere around 2.75%-3% by year-end.

The pace depends entirely on incoming data, particularly on the employment side. Inflation is less of a concern now—it’s the labor market that’s driving decisions.

For borrowers, this means relief is coming, but probably not all at once. Expect gradual rate reductions spread across several months rather than aggressive cuts front-loaded early in the year.

And remember: these are projections, not promises. Every FOMC meeting brings new data and new decisions. The Fed will adjust as conditions change.

But if Bowman’s assessment is right, 2026 should bring meaningfully lower borrowing costs than we’re seeing today.

The wait-and-see approach might feel frustrating if you’re hoping for immediate rate relief. But given the data quality issues and labor market fragility Bowman described, a measured approach makes sense.

Just keep watching those March employment and inflation reports. They’ll tell us whether those three cuts start soon—or whether the Fed decides to keep its powder dry a bit longer.