While savers are moving cash into high-yield time deposits, a different story is unfolding on the liability side of the consumer balance sheet. According to the Federal Reserve’s latest H.8 statistical release on January 23, 2026, credit card balances and other revolving plans at U.S. commercial banks have firmly crossed the $1 trillion threshold, signaling that consumer borrowing remains resilient despite elevated interest rates.

Breaking the $1 Trillion Barrier

The data shows a consistent upward climb in revolving credit throughout late 2025 and into early 2026. As of the week ending January 14, 2026, “Credit Cards and Other Revolving Plans” at all commercial banks reached $1,069.1 billion ($1.069 trillion).

- Seasonal Surge: Even after the typical holiday spending peak, balances remained high, increasing from $1,063.2 billion in December 2025.

- Long-Term Growth: This represents a significant jump from the $978.0 billion recorded in large domestic banks alone just over a year ago in December 2024.

The Inflation Connection

Consumer credit is inherently inflation-linked; as the cost of goods and services rises, so does the volume of credit required to maintain standard consumption. The H.8 report highlights that consumer loans grew at an annual rate of 3.8% in 2025. Specifically, credit cards and revolving plans saw a 3.3% annual growth rate during the same period.

Interestingly, while revolving credit remains high, non-revolving credit (such as auto loans) grew at a slower annual rate of 1.0% as of November 2025, suggesting consumers are leaning more heavily on their cards for flexible, day-to-day liquidity.

Borrowing Costs and Delinquency Trends

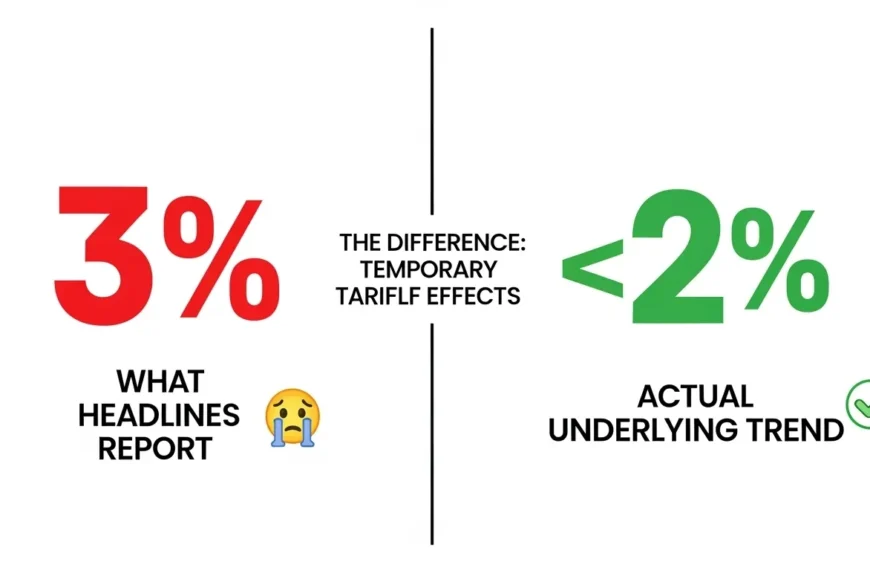

The strength in borrowing comes at a high price for consumers. Average APRs for accounts accruing interest stood at 22.30% in the final quarter of 2025. Despite these record-high borrowing charges, the 30-day delinquency rate showed signs of stabilization, dipping slightly to 2.98% toward the end of 2025.

Domestically Chartered Bank Breakdown

The debt is distributed across the banking sector as follows:

- Large Domestically Chartered Banks: These top 25 institutions hold the vast majority of card debt, totaling $969.8 billion as of mid-January.

- Small Domestically Chartered Banks: Community and regional banks account for $99.3 billion in revolving credit.

The FinexNews Outlook

The crossing of the $1 trillion mark is a double-edged sword. On one hand, it indicates that American consumers are confident enough—or squeezed enough—to continue spending. On the other, it represents a massive interest-bearing burden that could weigh on future economic growth if interest rates remain “higher for longer.”