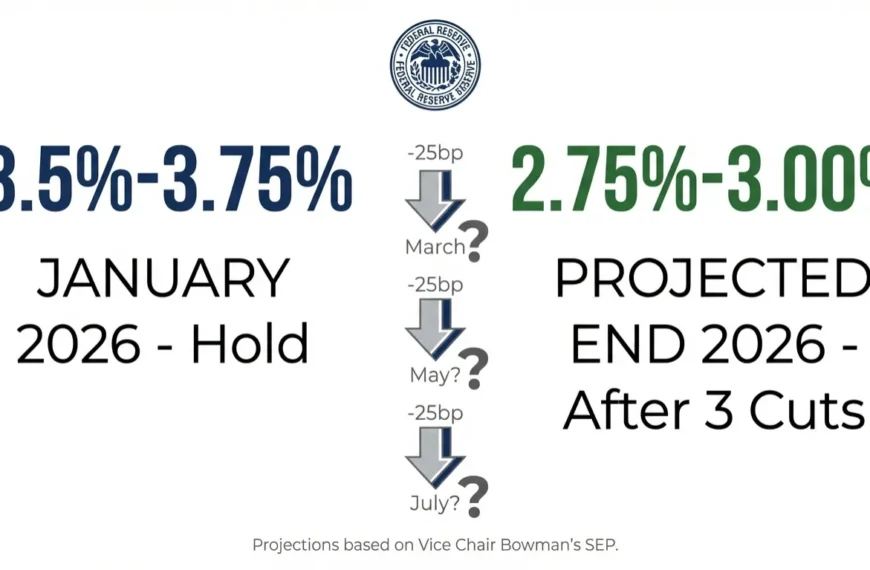

The Federal Reserve has officially hit the “pause” button. After a series of shifts, the Federal Open Market Committee (FOMC) decided to keep interest rates unchanged at its latest policy meeting, leaving the federal funds rate in a target range of 3.5% to 3.75%.

For most people, these percentages feel like abstract numbers. However, this decision impacts everything from your monthly mortgage payment to the interest sitting in your savings account.

⚡ Quick Summary: The Fed Decision at a Glance

- The Current Rate: 3.5% – 3.75%

- The Action: Unchanged (Pause)

- The Sentiment: Fed Chair Jerome Powell suggests policy is “restrictive enough” to cool inflation without killing growth.

- The Outlook: Data-dependent; no immediate cuts promised, but no further hikes expected.

What Is the Fed Funds Rate? (And Why You Should Care)

The fed funds rate is the interest rate banks charge each other for overnight loans. While it happens behind the scenes, it serves as the “master lever” for the US economy.

When this rate moves (or stays high), it dictates:

- Mortgage Rates: The cost of buying or refinancing a home.

- Credit Cards: The variable APR you pay on balances.

- Savings Yields: How much your bank pays you for High-Yield Savings Accounts (HYSA) and CDs.

- Business Loans: The cost for companies to expand and hire.

Why Did the Fed Pause Now?

After cutting rates by a total of 75 basis points over the previous three meetings, the Fed is now entering a “wait-and-see” phase. Policymakers pointed to a mixed but stable economic landscape:

- Inflation is Cooling: While not yet at the 2% target, the downward trend is consistent.

- Stable Jobs Market: Unemployment hasn’t spiked, but the frantic hiring of previous years has leveled off.

- Consumer Resilience: People are still spending, but high borrowing costs are beginning to slow down big-ticket purchases like homes and cars.

Winners and Losers of the 3.5%–3.75% Rate

| Feature | Impact | The Bottom Line |

| Savers | ✅ WIN | Rates on HYSAs and CDs remain near 4%, offering great passive returns. |

| Homebuyers | ⚠️ NEUTRAL | Mortgage rates likely won’t drop significantly yet, but the volatility may settle. |

| Credit Card Holders | ❌ LOSS | Interest charges remain high; it’s still an expensive time to carry a balance. |

| Stock Market | ✅ WIN | Investors generally cheer a “pause” as it signals a peak in borrowing costs. |

What Jerome Powell Said: “The Neutral Rate”

In his post-meeting comments, Fed Chair Jerome Powell emphasized that the Fed is looking for the “Neutral Rate”—a level where the economy isn’t being over-stimulated or overly restricted.

“We view the current stance of policy as appropriate… Decisions will be made meeting by meeting based on the totality of the data.”

Powell’s message was clear: The Fed is confident, but patient. They are in no rush to cut further until they are certain inflation won’t bounce back.

Does This Mean Rate Cuts Are Coming Soon?

Not necessarily. While the “hiking cycle” appears over, the “holding cycle” could last several months. To see a rate cut in the next meeting, we would need to see:

- A significant drop in monthly inflation reports.

- A noticeable weakening in the labor market.

- A decline in consumer spending.

What Should You Do?

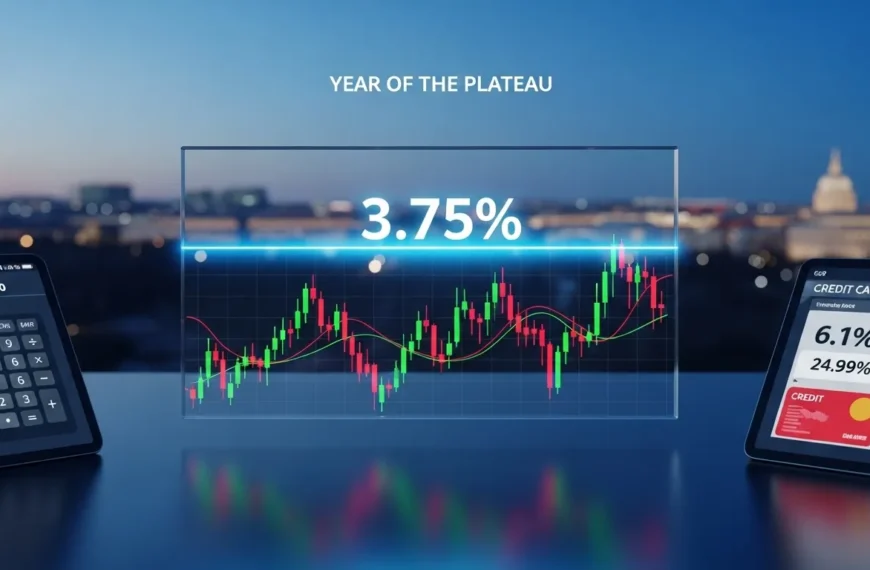

The current fed funds rate of 3.5% to 3.75% reflects a “Goldilocks” economy—not too hot, not too cold.

- For Borrowers: If you are waiting for 3% mortgage rates, you might be waiting a long time. 2026 is looking like the year of the “New Normal.”

- For Savers: Now is a great time to lock in long-term CD rates before any potential future cuts occur later this year.

What do you think of the Fed’s decision? Are you holding off on a big purchase, or are you happy with the returns on your savings? Let us know in the comments below!