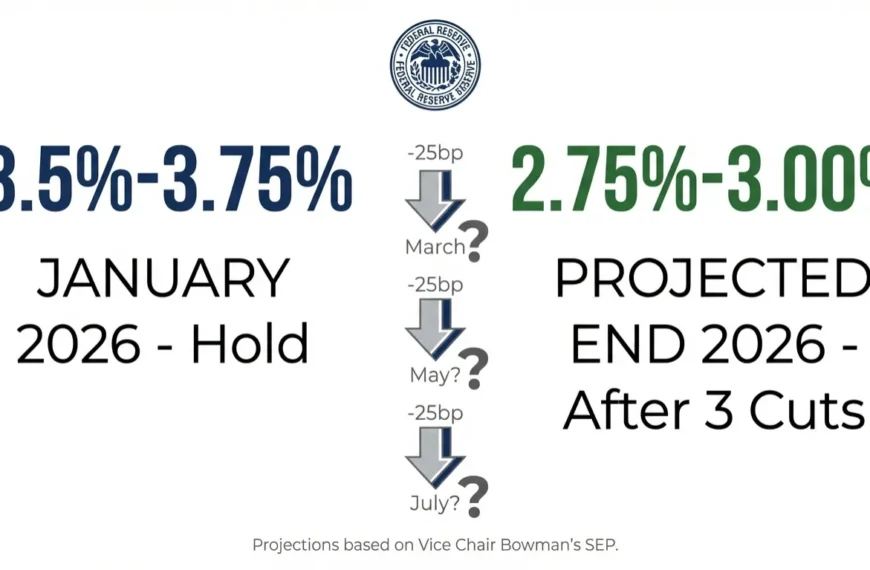

The Federal Reserve kicked off its first meeting of 2026 with a decisive “wait-and-see” move. On January 28, 2026, the FOMC voted to keep the federal funds rate at 3.5% to 3.75%, pausing the streak of cuts we saw late last year.

For millions of Americans, this decision signals that the “easy money” era isn’t coming back just yet. Whether you’re looking to buy a home in the spring or wondering why your credit card APR hasn’t budged, here is the breakdown of what this pause means for you.

2026 Interest Rate & Economic Forecast

While the Fed is holding steady today, Wall Street and top economists are already projecting what the rest of the year looks like. Use this table to plan your major financial moves:

| Economic Indicator | Current Level | Mid-2026 Forecast | Year-End 2026 Outlook |

| Fed Funds Rate | 3.5% – 3.75% | 3.25% – 3.5% | 3.0% – 3.25% |

| 30-Year Mortgage | ~6.1% | 5.75% – 5.9% | 5.5% – 5.7% |

| Inflation (PCE) | 2.8% | 2.5% | 2.4% |

| Unemployment | 4.4% | 4.5% | 4.4% |

Why the Fed is Hitting the “Pause” Button

Fed Chair Jerome Powell made it clear in his press conference: the economy is on “firm footing,” but the job isn’t finished. There are three specific reasons for this pause:

1. Inflation is “Stubborn”

While inflation has dropped significantly from its peak, it is still hovering around 2.8%—well above the Fed’s 2% target. With new trade tariffs potentially pushing up the cost of imported goods, the Fed is worried that cutting rates now could cause a second wave of price hikes.

2. The Labor Market is “Stable, Not Breaking”

The US job market is currently in a “low-hire, low-fire” phase. Unemployment has stabilized at 4.4%. Because we aren’t seeing a massive spike in layoffs, the Fed feels they don’t need to “rescue” the economy with aggressive cuts.

3. A Leadership Transition is Looming

With Jerome Powell’s term as Chair ending in May 2026, the committee is moving cautiously. There is significant political pressure for lower rates, but the Fed is working hard to prove its independence by letting the data—not the headlines—drive their decisions.

How This Decision Impacts You Right Now

For Homebuyers: The “6% Barrier”

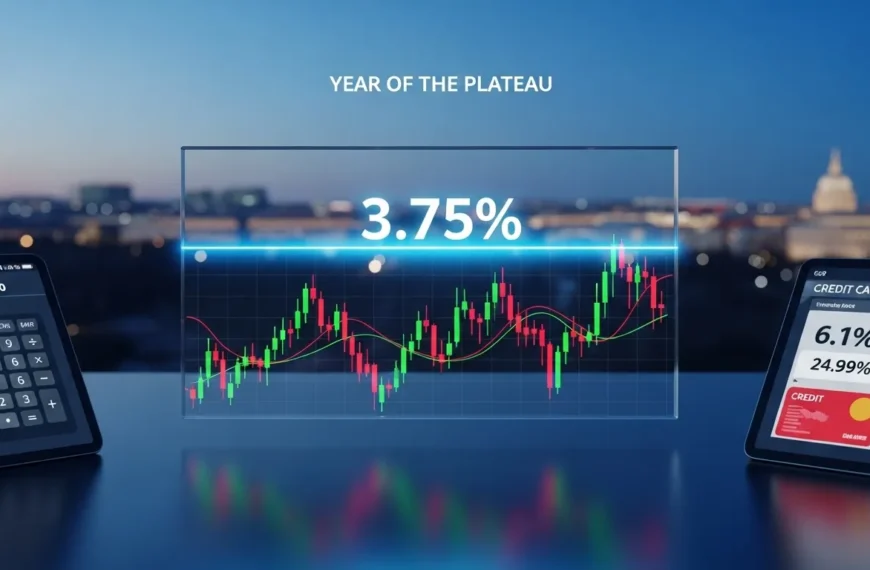

Mortgage rates have settled near 6.1%. While Morgan Stanley and Fannie Mae expect rates to dip below 6% by early summer, this pause means we won’t see a “mortgage miracle” this spring. If you’re buying, focus on your budget rather than waiting for a 3% rate that may never return.

For Savers: The “Golden Window”

High-yield savings accounts (HYSAs) and CDs are still paying 4% or higher. Since the Fed paused, these rates won’t drop immediately. Now is a prime opportunity to lock in a 12-month CD before the next round of cuts likely hits in June 2026.

For Borrowers: High APRs Persist

If you are carrying a balance on a credit card or looking for an auto loan, relief is coming slowly. Average credit card APRs remain near historical highs. The Fed’s pause means your monthly interest charges will stay exactly where they are for the foreseeable future.

The Bottom Line

The January 2026 meeting tells us that the Fed is confident but cautious. They believe the current 3.5%–3.75% range is the “neutral zone”—high enough to keep inflation down, but low enough to keep the economy growing.

What is your next move? * 🏠 Buying a home? Talk to a lender about a 5/1 ARM or refinancing options for later this year.

- 💰 Saving money? Lock in those 4%+ CD rates today.

- 💳 In debt? Prioritize paying down high-interest cards, as rates aren’t dropping soon.