3. Fed Meeting Key Signals: What the Market Is Worried About Right Now

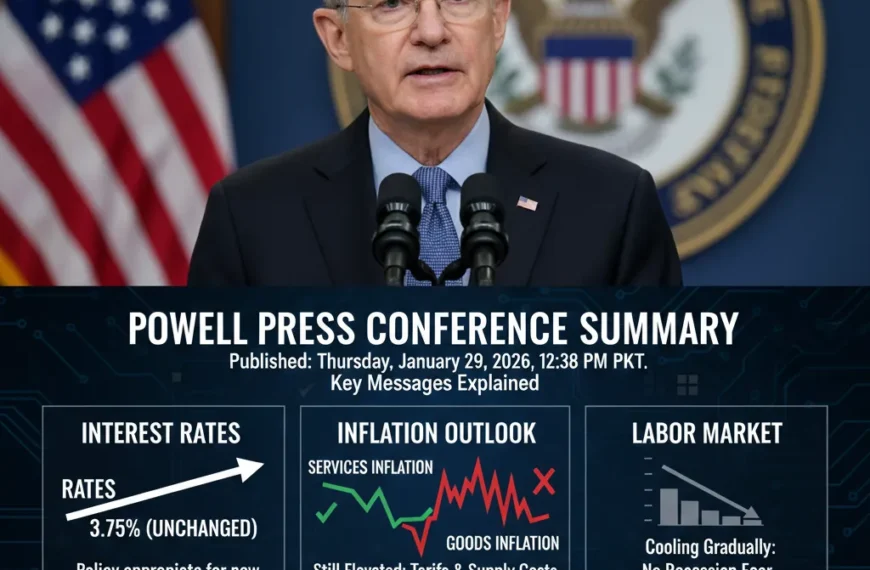

While the “rate hold” was the headline, the real story of the January 2026 Fed meeting was hidden in the footnotes. Investors and economists aren’t just looking at the number; they are obsessing over the “data fog” and the subtle shifts in Jerome Powell’s language.

If you want to know what the big players on Wall Street are actually whispering about, here are the three major signals from this latest meeting.

Signal 1: The “Low-Hire, Low-Fire” Paradox

The most confusing part of the current economy is the job market. Historically, when hiring slows down, layoffs go up. Right now, we are seeing something entirely different: Stagnation.

- The Signal: Powell noted that while job creation has slowed to a crawl (averaging just 20,000 to 50,000 new jobs a month), the unemployment rate hasn’t spiked. It’s a “frozen” market.

- The Worry: The market is terrified that this is a “calm before the storm.” If businesses stop hiring entirely, it only takes a small wave of layoffs to send the unemployment rate jumping from 4.4% to over 5% very quickly.

Signal 2: The “Tariff Wildcard” and Inflation

For the first time in years, the Fed is dealing with inflation that isn’t just about consumer demand—it’s about trade policy.

- The Signal: The FOMC statement hinted that “external factors and trade dynamics” are keeping goods prices higher than expected. This is code for tariffs.

- The Worry: Usually, when the economy slows down, inflation drops. But if new tariffs keep prices high while the economy weakens, the Fed gets stuck in a “Stagflation” trap. They won’t be able to cut rates to help the economy because prices are still rising.

Signal 3: The Search for the “Neutral Rate”

The biggest debate inside the Fed right now isn’t if they should cut rates, but where the “neutral rate” (the rate that neither helps nor hurts the economy) actually is.

- The Signal: Dissenting votes are appearing. Some Fed members wanted a cut now to prevent a recession, while others want to stay high to kill off the last of inflation.

- The Worry: The market hates a divided Fed. If the committee can’t agree on where rates should end up, it means they might wait too long to act, accidentally triggering the very recession they are trying to avoid.

Summary: What to Watch in the Coming Weeks

The Fed has made it clear: they are flying with a “broken compass” due to recent data disruptions. To see where the market is headed next, keep your eyes on these three reports:

- Jobless Claims: If these start to climb toward 250k+, the Fed will likely pivot to a “dovish” (rate-cutting) stance immediately.

- Retail Sales: If consumer spending drops, it’s a sign that high interest rates have finally broken the “resilient” American shopper.

- The New Fed Chair Nominee: With Powell’s term nearing its end, the market is bracing for a potential shift in how the Fed views its independence from politics.

| Market Fear | Why It Matters | Status |

| Data Lag | The Fed is making decisions based on old or “noisy” data. | 🔴 High Risk |

| Stagflation | Prices staying high while jobs disappear. | 🟡 Monitoring |

| Policy Error | The Fed waits too long to cut, causing a hard landing. | 🟠 Growing Concern |