The Federal Reserve holds its January FOMC meeting today, Wednesday, January 28, with markets closely watching for signals on interest rates, inflation, and the path of US monetary policy.

The FOMC policy statement is scheduled for 2:00 p.m. ET, followed by Federal Reserve Chair Jerome Powell’s press conference at 2:30 p.m. ET. Investors expect heightened market volatility throughout the session.

Below is a full breakdown of today’s Federal Reserve calendar and what to watch.

Fed Meeting Today – Key Times (Jan 28)

- 1:00 p.m. ET – Commercial Paper (CP)

- 2:00 p.m. ET – FOMC Policy Statement

- 2:30 p.m. ET – Jerome Powell Press Conference

- 4:15 p.m. ET – H.15 Selected Interest Rates

1:00 p.m. – Commercial Paper (CP)

The day begins with the release of Commercial Paper data, which tracks short-term borrowing activity by corporations.

Why it matters:

- Indicates liquidity conditions in financial markets

- Signals stress or stability in short-term funding

- Closely watched by institutional investors

2:00 p.m. – FOMC Policy Statement

The Federal Open Market Committee (FOMC) releases its policy statement at 2:00 p.m. ET.

Markets will focus on:

- Any change in interest rates

- Updates to inflation and growth outlook

- Language shifts compared to the previous statement

- Guidance on future policy moves

Even small wording changes can trigger sharp moves in stocks, bonds, and currencies.

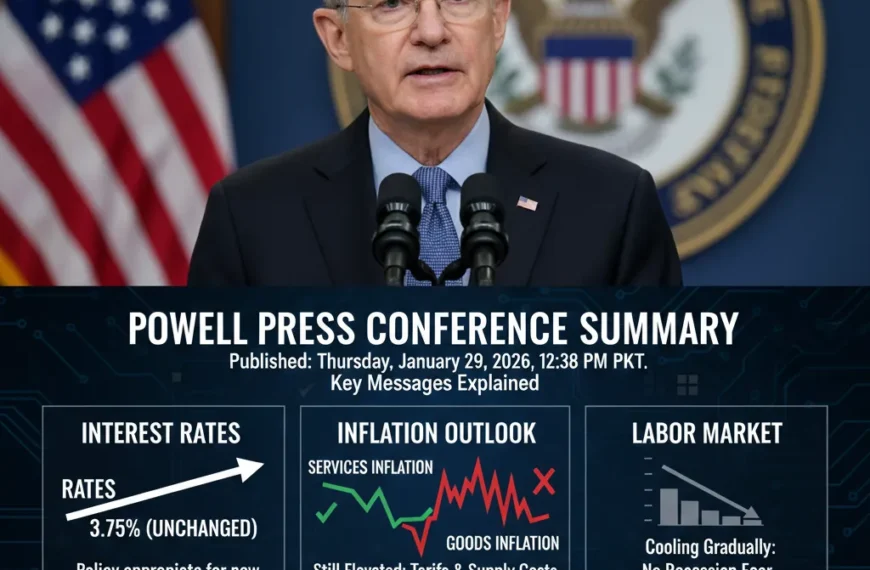

2:30 p.m. – Jerome Powell Press Conference

Federal Reserve Chair Jerome Powell will speak 30 minutes after the policy statement.

This is often the most market-moving part of Fed day.

Key points investors will watch:

- Powell’s tone on inflation progress

- Comments on the labor market

- Signals on potential rate cuts or delays

- Responses to questions on economic risks

4:15 p.m. – H.15 Selected Interest Rates

The Federal Reserve will release the H.15 Selected Interest Rates report later in the day.

This report includes:

- Treasury yields

- Benchmark interest rates

- Short- and long-term rate movements

It helps confirm how markets reacted to the Fed’s decisions and messaging.

What This Means for Markets

With both an FOMC statement and a Powell press conference scheduled, markets are likely to see increased volatility.

Assets to watch:

- US stock market

- Treasury yields

- US dollar

- Gold and crypto markets

Any surprise in tone or guidance could drive sharp price swings before the market close.

What to Watch After the Fed Meeting

- Headline changes in the FOMC statement

- Powell’s comments on rate timing

- Market reaction during the final hour of trading

- Bond yield movement after the H.15 release

Finex News will continue to track Federal Reserve updates and market reaction throughout the day.

❓ Frequently Asked Questions

What time is the FOMC statement today?

The Federal Reserve releases the FOMC policy statement at 2:00 p.m. ET on January 28.

What time is Jerome Powell’s press conference?

Jerome Powell speaks at 2:30 p.m. ET, shortly after the FOMC statement.

Will the Fed change interest rates today?

Markets expect the Fed to provide guidance on future rate moves, with close attention on inflation and labor market conditions.