In the world of finance, words are just as valuable as currency. When Federal Reserve Chair Jerome Powell speaks, trillions of dollars shift across global markets. For investors and everyday savers alike, understanding the “Powell Effect” is the key to anticipating where the economy is headed.

Following a turbulent start to 2026, including a landmark defense of the Fed’s independence on January 11, here is how Powell’s recent rhetoric is moving the three pillars of the market.

1. The Stock Market: Stability Amidst the “Pause”

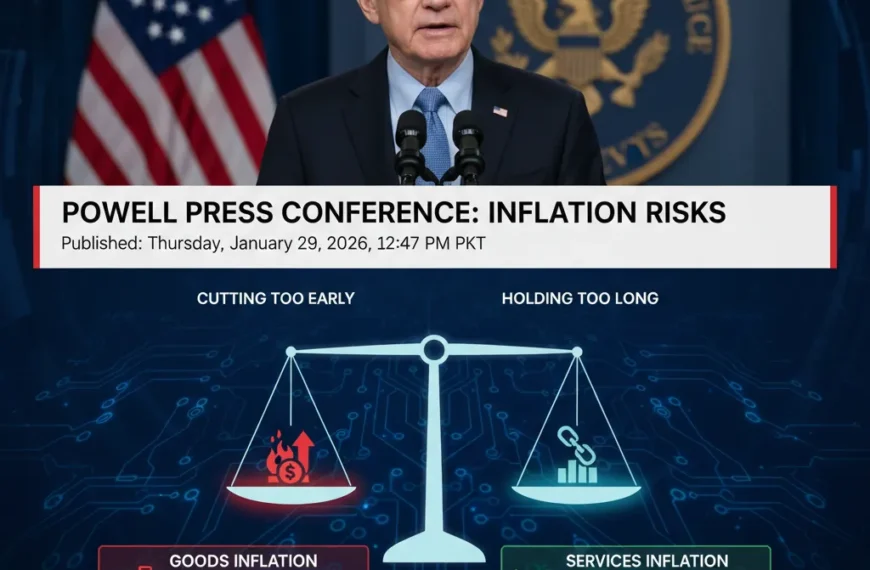

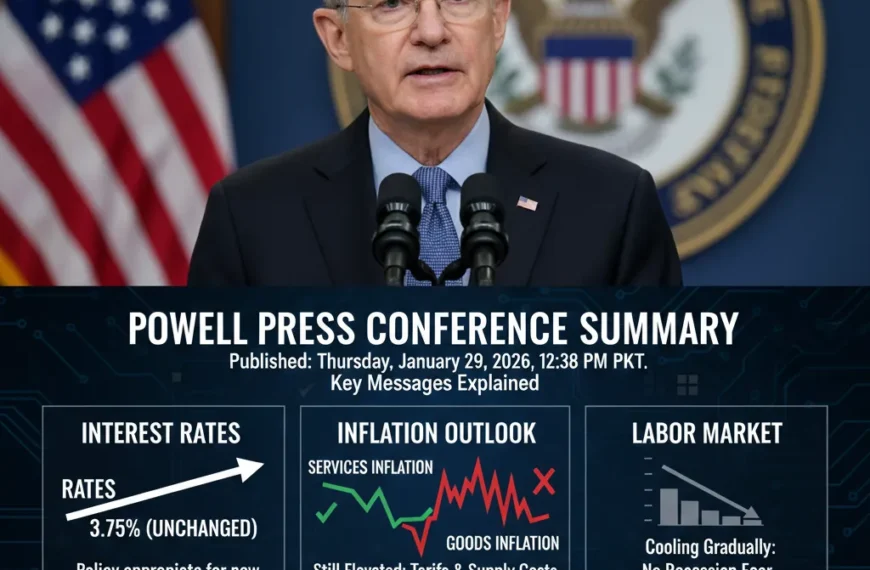

Historically, the stock market loves low interest rates. However, in his most recent updates, Powell signaled a “pause” in the rate-cutting cycle that began late last year. Usually, a pause might cause stocks to dip, but the reaction this January has been surprisingly resilient.

- The Movement: Major indexes like the S&P 500 and Dow Jones have recently closed at new highs.

- Why? Investors are prioritizing certainty over cheap money. By standing firm on the Fed’s independence despite political pressure, Powell has signaled that the Fed will remain a stable, data-driven institution. This “independence premium” has kept investor confidence high, even without the promise of immediate rate cuts.

2. Bond Yields: The “Risk-Free” Compass

The bond market is often the first to react to Powell’s tone. Bond yields (the interest paid on government debt) move based on where the market thinks the Fed will set rates in the future.

- The Movement: The 10-year Treasury yield recently ticked higher, hovering between 4.10% and 4.20%.

- Why? Because Powell indicated that the bar for future rate cuts is now higher (due to “sticky” inflation around 2.8%), investors are demanding higher yields to hold long-term debt. When Powell says “we’re well-positioned to wait and see,” bond yields typically stay elevated, which keeps mortgage rates from falling significantly.

3. The US Dollar: The Global Safe Haven

The US dollar’s strength is tied to how much global investors want to hold American assets. Higher-for-longer interest rates make the dollar more attractive.

- The Movement: The US dollar index has remained strong, even advancing marginally in late January.

- Why? Powell’s “hawkish” stance (holding rates steady) compared to other global central banks has made the dollar a preferred choice. Additionally, during moments of political or economic tension—such as the recent DOJ inquiry into the Fed—the dollar often benefits from “safe-haven” buying as investors trust the Fed’s long-term stability over short-term drama.

Summary: The Powell Market Map

| Market | Recent Reaction | The “Powell” Reason |

| Stocks | 📈 Up / Stable | Trust in Fed independence and predictable policy. |

| Bonds | 📈 Yields Rising | Higher expectations for rates to stay steady (no quick cuts). |

| US Dollar | 📈 Strengthening | US rates remain more attractive than global alternatives. |

What This Means for Your Strategy

Understanding how Powell moves markets helps you filter out the noise. If bond yields are rising, it might not be the best week to lock in a new mortgage. If the dollar is strong, your international travel or imported goods might stay slightly more affordable.

As we look toward the January 29 FOMC meeting, the market isn’t just watching the interest rate number—it’s watching Powell’s vocabulary.