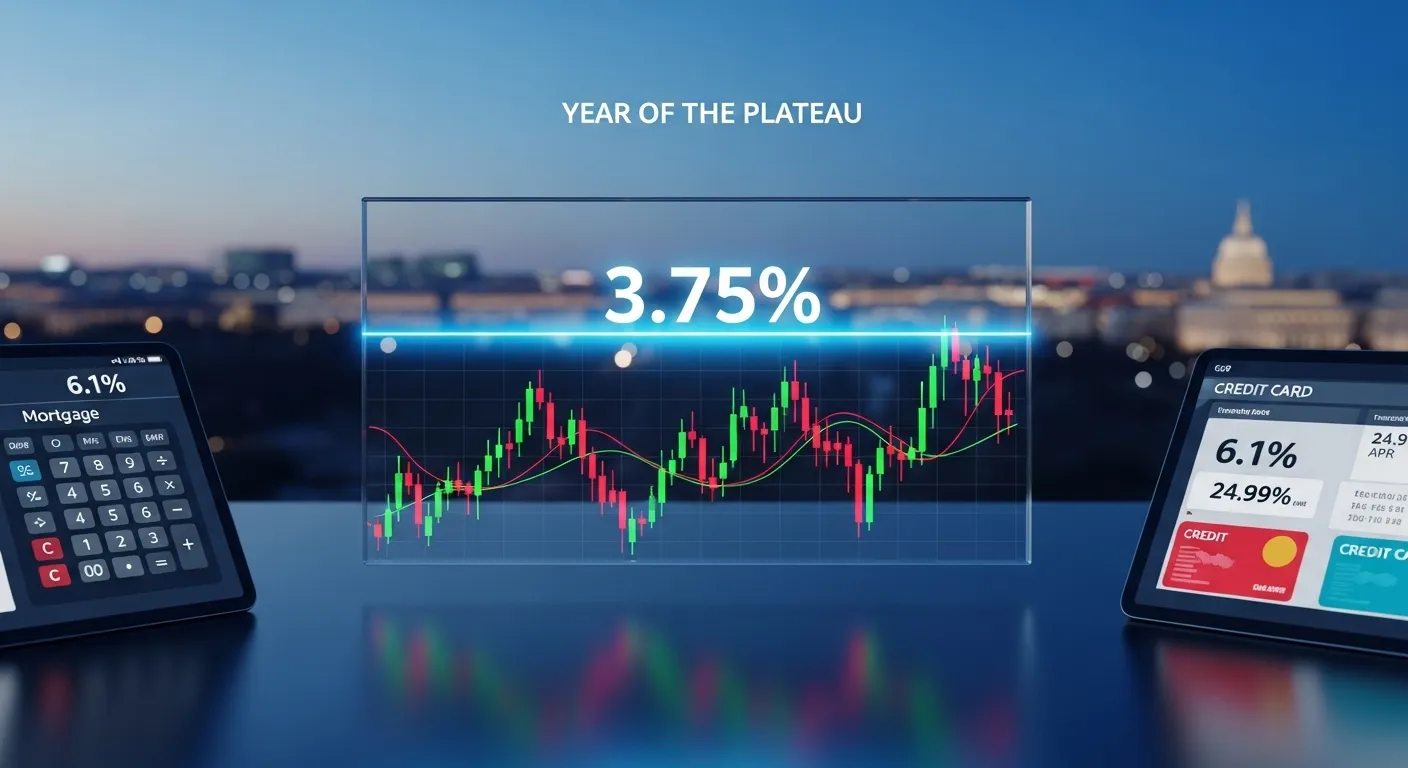

US interest rates are no longer rising, but they are not falling either.

After years of aggressive tightening, the Federal Reserve has moved into what officials increasingly describe as a fine-tuning phase. The Effective Federal Funds Rate currently sits near 3.64%, firmly inside the 3.50% to 3.75% target range.

That range has quietly become a ceiling. And for 2026, it may also become a plateau.

From Peak Tightening to a Policy Plateau

The current calm only makes sense when viewed against recent history.

Between 2022 and 2024, the Fed executed one of the fastest tightening cycles in decades, lifting rates from near zero to deeply restrictive levels. By late 2025, inflation cooled enough for policymakers to begin easing, bringing rates down from their peak.

Even after those cuts, policy remains tight by historical standards. The Fed may have stopped braking aggressively, but it has not started accelerating either.

The Neutral Rate Debate, Why the Goalposts Keep Moving

At the center of the 2026 rate debate is the concept of the neutral rate, often called r-star. This is the level of interest rates that neither stimulates nor restrains economic growth.

Many Fed officials still place neutral near 3.0%. At first glance, that suggests today’s policy stance remains meaningfully restrictive.

But that assumption is increasingly under scrutiny.

Strong AI-driven investment, heavy government spending, and structurally larger budget deficits may have lifted the economy’s underlying speed limit. Some institutions, including RSM and the Peterson Institute for International Economics, argue neutral could now be closer to 3.5%.

If that is correct, today’s 3.64% policy rate is barely restrictive at all. This helps explain why growth has remained resilient and why inflation has proven harder to fully extinguish.

Why Holding Rates Is Still the Base Case for 2026

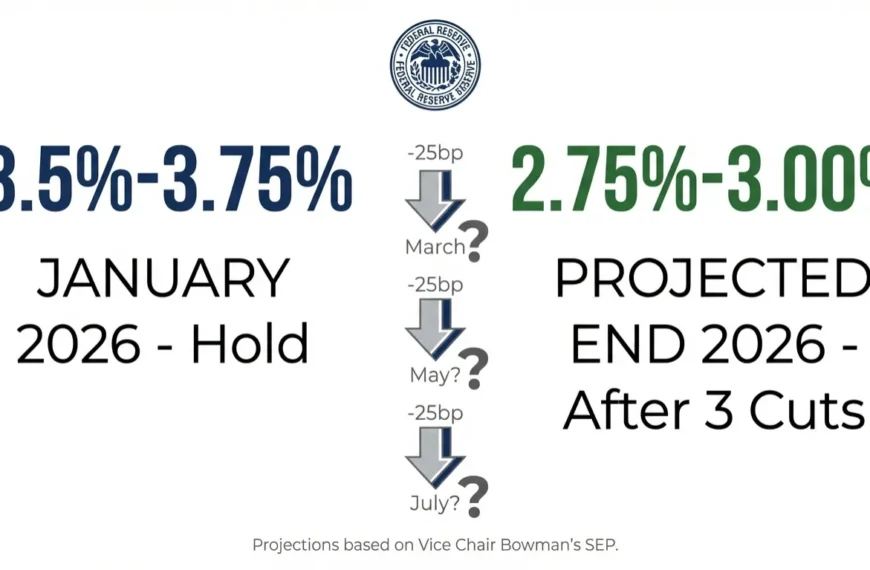

Despite the uncertainty around neutral, the policy outlook is surprisingly clear.

Major institutions such as J.P. Morgan expect the Fed to remain on hold for much of 2026. Inflation has cooled, but progress has slowed. Growth has moderated, but it has not cracked.

With fiscal policy still supporting demand, the Fed sees little upside in rushing further cuts. Holding steady is not hesitation. It is risk management.

The Borrowing Reality, Why Rates Still Feel Painful

For households and businesses, the rate plateau feels anything but neutral.

The bank prime loan rate remains near 6.75%, keeping borrowing costs well above pre-2022 norms. This is where Fed policy meets everyday reality.

Mortgages:

Even after late-2025 rate cuts, mortgage rates stayed stubbornly high. Long-term yields have been pushed up by a rising term premium, as investors demand more return to hold long-dated debt amid large government deficits.

Credit cards:

Most credit card APRs are priced at the prime rate plus a margin. For many consumers, that still means interest rates north of 21% to 24%, with little immediate relief.

The Fed may be easing at the margins, but the pass-through to household finances remains slow.

A 2026 Rate Reality Check

| Rate Type | Jan 2025 (Peak) | Jan 2026 (Now) | Explanation |

|---|---|---|---|

| Fed Funds Rate | 5.25%–5.50% | 3.50%–3.75% | Fine-tuning for a soft landing |

| Bank Prime Rate | ~8.50% | ~6.75% | Baseline for most consumer loans |

| 30-Year Mortgage | ~7.2% | ~6.1% | Elevated term premium |

What Could Break the Plateau?

For rates to move materially lower, the Fed would likely need a clear catalyst.

- The tariff lag: Analysts are watching for a second wave of inflation in 2026 as 2025 tariffs fully filter through retail prices.

- Labor market deterioration: A sustained rise in unemployment would force a policy response.

- Leadership uncertainty: The May 2026 expiration of Chair Jerome Powell’s term has created a natural caution window, reducing the odds of bold moves.

- Political risk: The Fed is also navigating an unusual public standoff with the White House, including pressure tied to audits and legal pretexts. Historically, this kind of political noise pushes the Fed to hold rates steady to protect its independence.

Absent a shock, stability remains the default.

Final Take

The 3.75% ceiling is not just a number. It is a fortress.

The Fed has built this wall to ensure the inflation ghosts of 2022 do not return. For markets, that means fewer cuts than once expected. For consumers, it means adapting to a world where borrowing costs remain structurally higher.

2026 is shaping up as the year of the plateau, when waiting for the next cut gives way to learning how to live with rates that finally carry weight again.