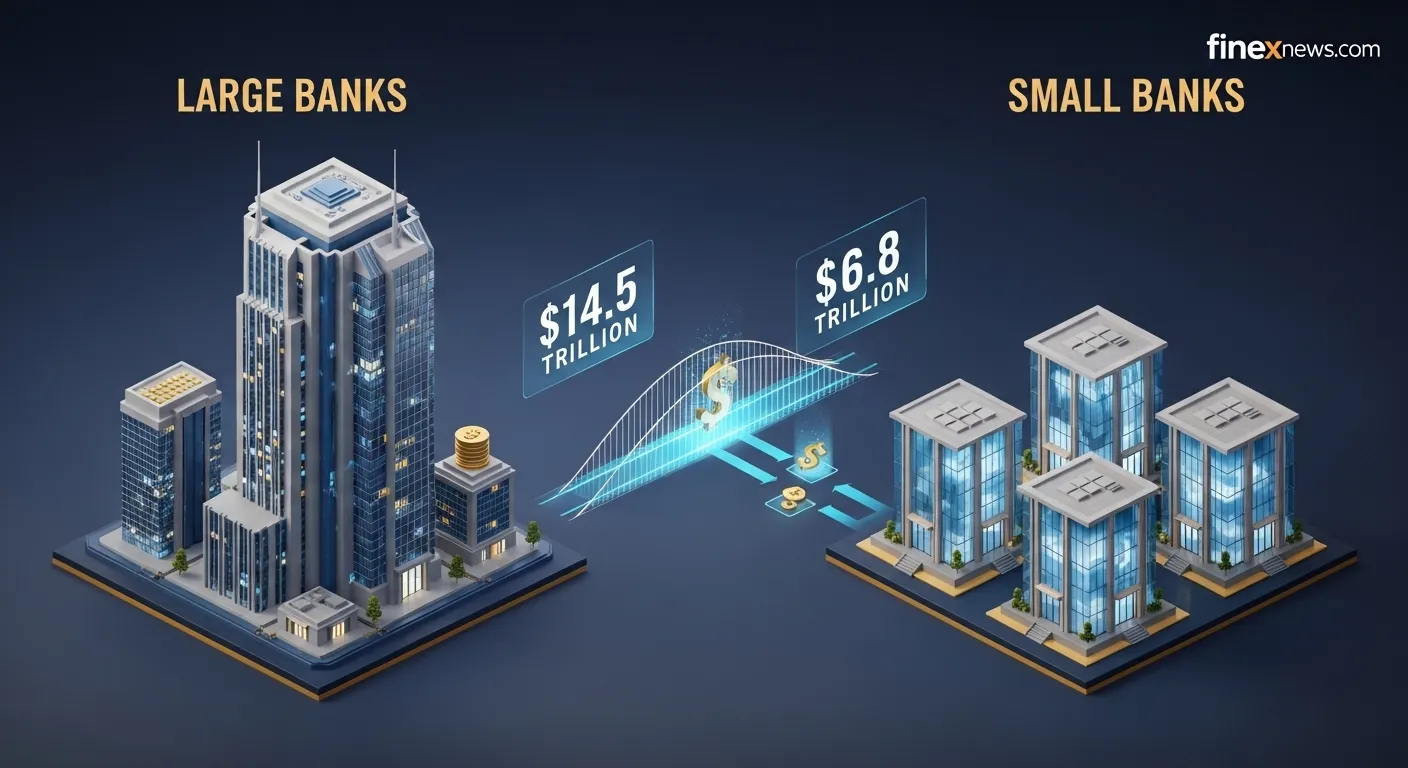

The structural landscape of American finance remains a study in scale. The Federal Reserve’s H.8 statistical release for January 2026 provides a clear look at the concentration of financial power, showing that the nation’s largest institutions hold a massive $14.5 trillion in total assets, even as smaller regional and community banks carve out a path of consistent growth.

The Scale of Large Domestically Chartered Banks

The “Large” bank category—defined as the top 25 domestically chartered commercial banks—continues to anchor the U.S. financial system. As of the week ending January 14, 2026, these institutions managed a combined $14,540.4 billion ($14.54 trillion) in assets.

- Bank Credit Leadership: Large banks account for $11,536.0 billion in total bank credit, including the majority of the nation’s securities and industrial loans.

- Liquidity Management: These top-tier banks held $1,383.9 billion in cash assets mid-month, providing a significant liquidity buffer for the broader economy.

Small Banks: The Engine of Steady Growth

While they lack the massive scale of the top 25, small domestically chartered banks (all those outside the top 25) represent a vital and growing segment of the market. Total assets for this group reached $6,868.5 billion as of January 14, 2026.

- Consistent Expansion: Small bank assets grew steadily from $6,588.0 billion in December 2024 to their current $6.87 trillion level.

- Real Estate Focus: Small banks continue to punch above their weight in property lending, holding $3,140.6 billion in real estate loans—surpassing the $2,491.0 billion held by their much larger counterparts.

Market Share and Structural Impact

The total asset landscape for all commercial banks in the U.S. stands at $24,734.0 billion. This is distributed across three primary groups:

- Large Domestic Banks: ~58.8% market share ($14.54 trillion).

- Small Domestic Banks: ~27.8% market share ($6.87 trillion).

- Foreign-Related Institutions: ~13.4% market share ($3.33 trillion).

The FinexNews Outlook

The divergence in asset focus—large banks leading in industrial and security credit, while small banks dominate real estate—highlights the symbiotic nature of the U.S. banking system. While the $14.5 trillion concentrated in the top 25 banks ensures global competitiveness and systemic stability, the steady growth of small banks ensures that local real estate and community needs remain funded.