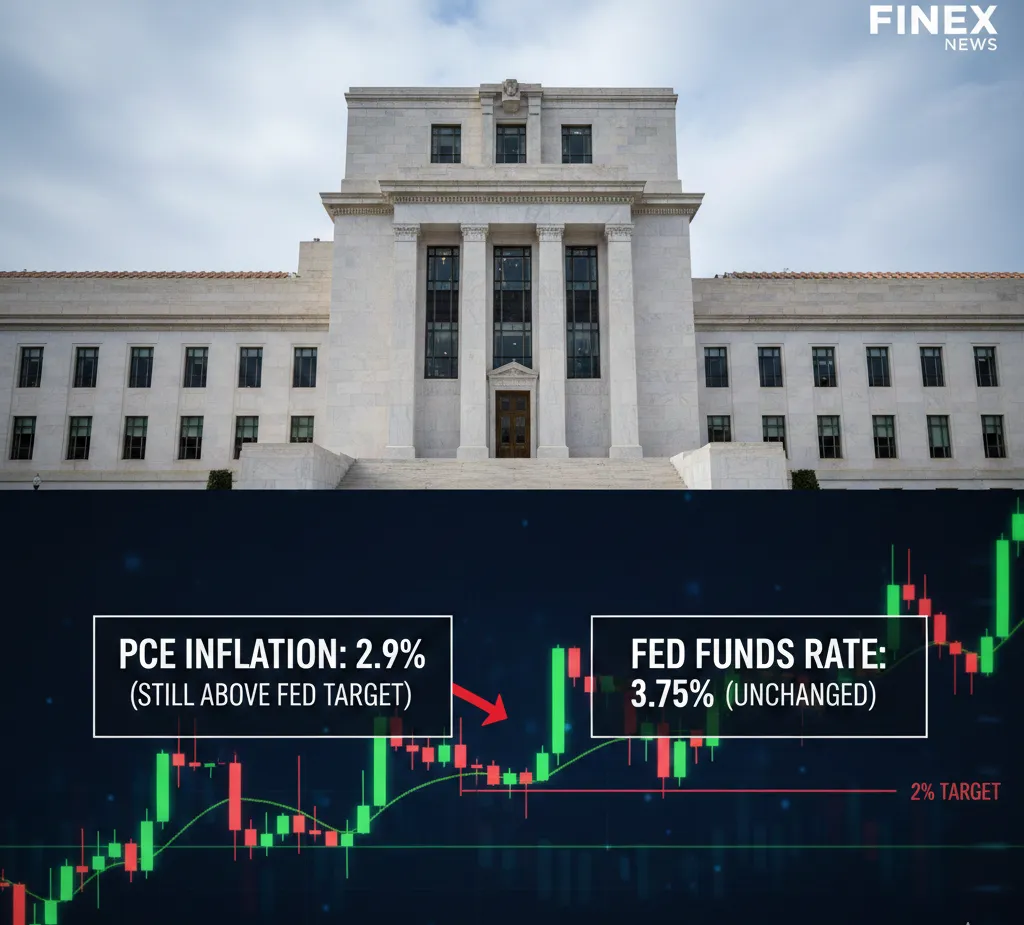

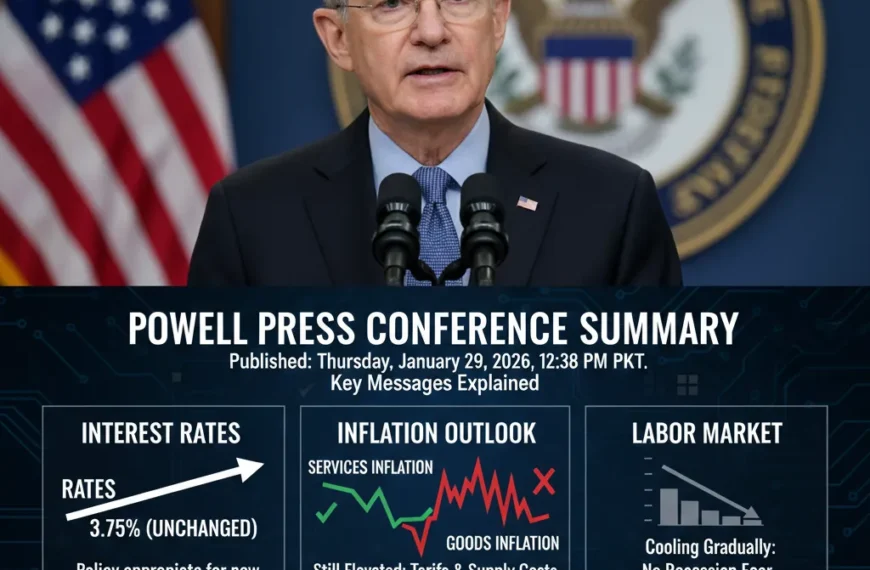

The Federal Reserve kept interest rates unchanged at its first policy meeting of 2026 on Wednesday, January 28, following three consecutive cuts in late 2025. The Federal Open Market Committee (FOMC) maintained the federal funds rate at 3.50% to 3.75%, citing a “solid pace” of economic growth while noting that inflation remains above its long-term 2% target. Federal Reserve Chair Jerome Powell stated that the central bank is now in a “wait-and-see” position to evaluate incoming data before making further adjustments.

The Personal Consumption Expenditures (PCE) price index remains the Fed’s preferred gauge because it tracks a broader range of spending than the Consumer Price Index (CPI) and accounts for how consumers change their buying habits when prices rise.

What the Latest PCE Data Shows

Preliminary estimates released in late January 2026 show that inflation pressures have not yet fully subsided:

- Headline PCE Inflation: Estimated at 2.9% for the 12 months ending in December 2025.

- Core PCE Inflation: Estimated at 3.0% for the same period.

- Trend: While significantly lower than the peaks seen in 2022, progress has slowed. Headline PCE was at 2.8% in November 2025, showing a slight uptick in the final month of the year.

Why PCE Matters More Than CPI

The Fed relies on the PCE index over the CPI for three main reasons:

- Consumer Behavior: PCE accounts for “substitution,” such as consumers buying chicken when the price of beef rises.

- Broader Scope: It includes expenditures made on behalf of consumers, like employer-paid healthcare.

- Formula Accuracy: The PCE uses a formula that better tracks the changing weights of items in the typical American “basket” of goods.

Powell’s Key Comments on PCE Inflation

During the January 28 press conference, Chair Powell noted that while the outlook for growth is “stronger,” inflation remains “somewhat elevated.” He clarified that the Fed is looking for “greater confidence” that inflation is moving sustainably toward 2%. Powell specifically mentioned that core inflation likely hit 3% in December, which reinforces the need for a cautious policy approach.

Goods vs Services Inflation

The Fed is closely monitoring two distinct sectors:

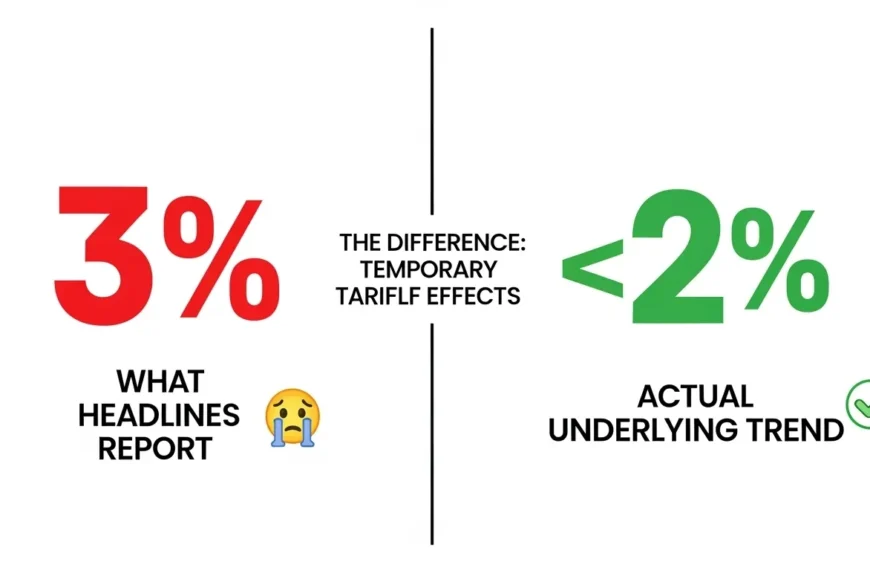

- Goods Inflation: Prices for physical products have shown continued upward pressure. Powell attributed much of this to recent tariffs, which he described as a “one-time price” event rather than a permanent demand-driven spike.

- Services Inflation: This sector showed signs of easing toward the end of 2025, which is a positive signal for the Fed as services (like rent and insurance) are typically harder to cool down.

Inflation Expectations and Fed Confidence

The Fed tracks how the public perceives future price moves:

- Near-term: Monthly data continues to fluctuate, keeping the Fed alert.

- Long-term: Powell reported that long-term expectations remain “well-anchored.”

- Significance: If the public expects prices to stay high, businesses raise prices and workers demand higher pay, making inflation harder to fix.

What This Means for Interest Rates

With the Fed choosing to pause in January, interest rates are expected to stay at current levels for an extended period. Markets are no longer expecting immediate or aggressive rate cuts. Instead, the FOMC is taking a meeting-by-meeting approach. The Fed intends to let the high rates continue to “restrict” the economy until inflation hits the 2% goal.

What Could Change the Fed’s View

Three factors could prompt the Fed to restart rate cuts or even consider hikes:

- Core PCE Decline: A rapid drop toward 2.1% would likely trigger a June rate cut.

- Tariff Impact: If goods inflation reaccelerates beyond a “one-time” price hit.

- Labor Market: A sudden spike in unemployment could force the Fed to prioritize jobs over inflation.

Market Reaction to Powell’s Inflation Message

Following the January 28 announcement:

- Bond Market: Treasury yields remained stable as investors accepted the “long pause” narrative.

- The Dollar: The U.S. Dollar index rose as global investors favored the higher interest rates available in the U.S.

- Stock Market: Markets were mixed, balancing strong economic growth against the reality of higher-for-longer borrowing costs.

What to Watch Next

The next critical data points for Finex News readers are:

- February 20, 2026: The Bureau of Economic Analysis (BEA) will release the official January PCE data.

- February 11, 2026: January CPI data will provide the first signal of the 2026 inflation trend.

- Upcoming Jobs Reports: Stalling job growth could shift the Fed’s focus in the spring.

The Federal Reserve has entered an extended pause. While the U.S. economy is expanding at a solid pace, the Fed is not yet convinced that inflation is fully defeated. Patience is the current strategy, and the 2% target remains the firm objective for 2026.