The Federal Reserve concluded its first policy meeting of 2026 on Wednesday, January 28, by keeping interest rates unchanged at 3.50% to 3.75%. While the decision to hold rates was widely expected, Fed Chair Jerome Powell’s post-meeting press conference provided critical details on the central bank’s shift toward an extended pause. Powell signaled that the Fed is now in a “wait-and-see” mode to assess the impact of previous cuts and the recent spike in goods prices.

Powell’s Overall Tone

Chair Powell maintained a calm but cautious assessment of the U.S. economy. He described economic activity as expanding at a “solid pace” and noted that the outlook for growth has “clearly improved” since the end of 2025. This positive framing suggested that the Fed is not currently fearing a recession, which helped steady market nerves despite the pause in rate cuts.

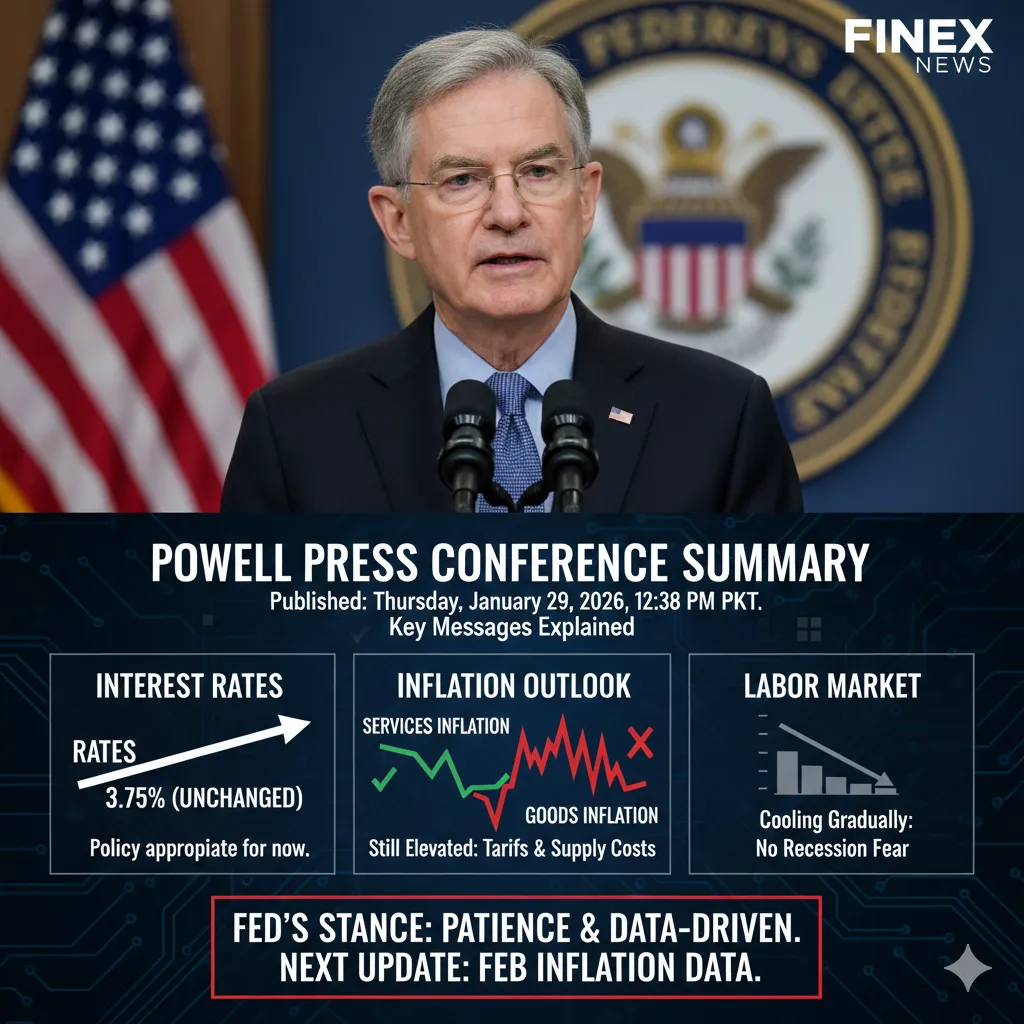

Powell on Interest Rates

The Fed held rates steady following three consecutive quarter-point cuts in late 2025. Powell explained that current policy is “modestly restrictive” but appropriate for the current economic environment. He reinforced that there is “no preset course” for future moves, confirming the Fed will continue its meeting-by-meeting approach based on incoming data.

Powell on Inflation

Powell acknowledged that inflation has eased from its 2022 highs but noted it remains “somewhat elevated” above the 2% goal.

- Core PCE: Powell stated that core inflation likely hit 3.0% in December.

- Goods vs. Services: He highlighted a split where services inflation is easing, but goods inflation has risen due to one-time tariff effects. Powell noted that if inflation was rising due to demand, it would be a harder problem to solve, but tariff-driven spikes are often temporary.

Powell on the Labor Market

The Fed chief addressed concerns about the labor market by noting that while job gains have remained low, the unemployment rate shows signs of stabilization. He attributed the slower job growth partly to a decline in labor force participation and lower immigration rates. Overall, the Fed does not see a “strong signal” of a deteriorating job market that would require urgent rate cuts.

Powell on Economic Growth

The growth forecast for 2026 is currently stronger than it was a year ago.

- Consumer Spending: Numbers remain “good” despite varied income levels.

- Business Investment: Powell specifically mentioned that the economy is benefiting from the AI buildout of data centers.

- Housing: While not a central focus of the conference, the Fed is watching how the current rate pause affects long-term affordability.

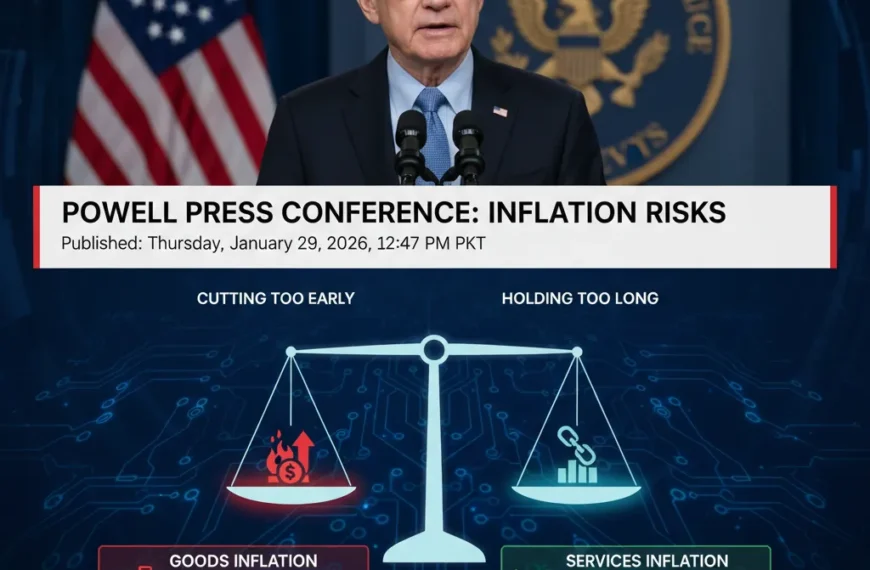

Powell on Risks and Uncertainty

Powell described a “tension between the mandates” of price stability and maximum employment.

- Cutting too early: Risks re-igniting inflation, especially with new fiscal pressures.

- Holding too long: Risks unnecessary damage to the labor market.The Fed is balancing these risks by remaining in a “good place” with current rates while they monitor how the economy performs.

Key Powell Quotes

| Topic | Powell’s Message | Why It Matters |

| Interest rates | “Policy is appropriate to support both of our goals.” | Signals a long pause. |

| Inflation | “Most of the overshoot… is from tariffs.” | Suggests inflation is not demand-led. |

| Labor market | “Some signs of stabilization.” | Cuts are no longer an emergency. |

| Policy path | “Let the data speak to us.” | Decisions are meeting-by-meeting. |

How Markets Interpreted Powell’s Message

The stock market showed mixed results as investors balanced strong economic growth against the reality of a “long pause” in rate cuts. Bond yields remained relatively stable, and the U.S. Dollar index rose as investors adjusted to the idea that rates will not fall further in the immediate future. Gold and silver prices saw a brief pull-back before continuing their upward trend.

What Powell Did Not Say

Notably, Powell provided no timeline for the next rate cut, with some analysts now pushing expectations back to June 2026. He also refused to comment on political pressure, the DOJ investigation into his tenure, or speculation regarding his successor. This silence was intended to protect the independence of the central bank.

What to Watch After the Press Conference

The next steps for the Fed depend on three key indicators:

- PCE Data: The January report (due late February) will show if tariff effects are truly “one-time.”

- Jobs Reports: Any spike in unemployment could force the Fed to cut rates sooner.

- Financial Conditions: The Fed will watch if the market remains “supportive” of economic growth.

The January press conference confirmed that the Fed is no longer in a hurry to lower borrowing costs. Chair Powell’s emphasis on “patience” and “stabilization” suggests that the current interest rate level will likely remain the standard for at least the first half of 2026.