The U.S. economy is exhibiting a clear divergence in its borrowing habits, creating a “two-speed” market. While the corporate sector continues to show surprising resilience by leveraging credit for growth, the property market is entering a period of digestion.

The Federal Reserve’s H.8 statistical release for January 2026 provides a stark contrast, highlighting the continued climb in Commercial and Industrial (C&I) loans alongside a significant slowdown in real estate lending .

Part I: The Resilient Corporate Sector and C&I Loans

Despite a persistent “higher-for-longer” interest rate environment, American businesses are actively investing. Total Commercial and Industrial loans at all commercial banks reached $2,733.8 billion ($2.73 trillion) as of the week ending January 14, 2026. This notable increase from the $2,698.6 billion recorded in December 2025 signals that corporations are finding productive uses for capital that outweigh the increased cost of borrowing.

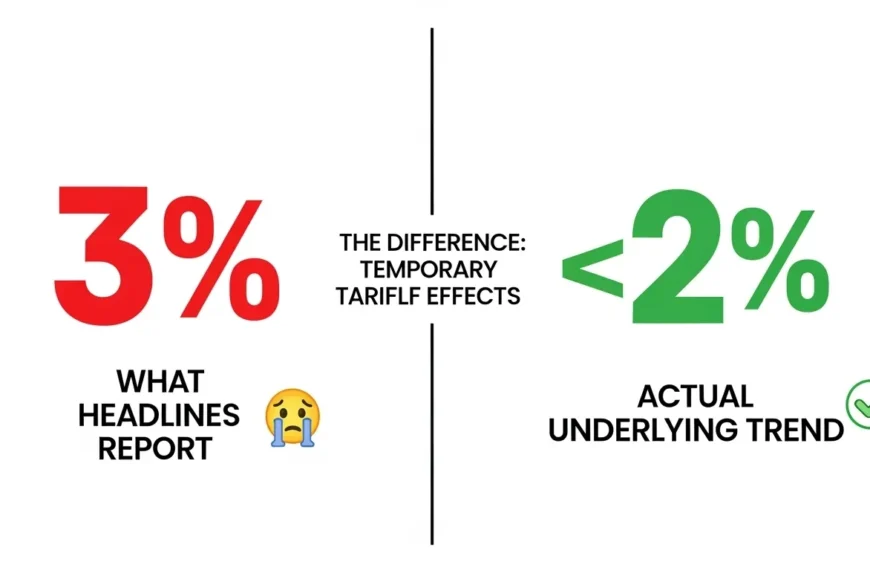

The annual growth rate for C&I loans in 2025 was 4.3%. While growth moderated in the final quarter of 2025 (3.0% annualized) after a strong third quarter (7.9% annualized), the overall trend remains positive, suggesting that the “hard landing” some economists feared for the business sector has yet to materialize.

A key indicator of market activity is the surge in lending to nondepository financial institutions (like private equity and hedge funds), which hit $1,846.0 billion in mid-January, indicating high liquidity needs and active capital reallocation across the broader financial ecosystem.

Part II: The Cooling Property Market and Real Estate Loans

In sharp contrast to the corporate sector, the property market is experiencing a significant cooling. Total real estate loans across all commercial banks reached $5,749.2 billion ($5.75 trillion) in mid-January 2026. However, the pace of growth has decelerated sharply, with real estate lending growing at a modest 1.9% annual rate in 2025. This is a steep drop from the 10.2% growth seen in 2022, confirming that high borrowing costs are reshaping the housing and commercial sectors.

The data reveals a divergence within the property market:

| Real Estate Sub-Sector | Mid-Jan 2026 Value (Billions) | 2025 Annual Growth Rate | Key Trend |

| Residential Mortgages | $2,681.9 | 2.2% | Steady, but slow growth. |

| Home Equity Lines of Credit (HELOC) | N/A | 6.2% | Fastest-growing sub-sector, indicating homeowners seeking liquidity. |

| Commercial Real Estate (CRE) | $3,067.3 | 1.6% | Significant slowdown from previous years. |

| Construction & Land Development | $452.0 | N/A (Downward Trend) | Continued pullback in new development financing. |

The high growth in HELOCs (6.2% annually) is particularly noteworthy, suggesting that homeowners are leveraging their primary assets to navigate current economic pressures, a trend that warrants close monitoring.

Divergence in Bank Exposure

The two-speed economy is also reflected in the lending patterns of different bank types. Large, domestically chartered banks dominate C&I lending, while small and regional banks maintain a much higher exposure to the real estate sector.

| Lending Category | Large Domestically Chartered Banks (Billions) | Small Domestically Chartered Banks (Billions) | Foreign-Related Institutions (Billions) |

| Commercial & Industrial (C&I) Loans | $1,436.7 | $738.1 | $559.0 |

| Real Estate Loans | $2,491.0 | $3,140.6 | $117.6 |

Small domestically chartered banks hold $3,140.6 billion in real estate loans—more than half of the total market—making them highly sensitive to any further cooling or distress in the property sector. Conversely, large banks hold the bulk of C&I loans, positioning them to benefit from the corporate sector’s continued resilience.

The FinexNews Outlook

The January 2026 H.8 data paints a picture of a bifurcated economy. The corporate sector, fueled by C&I loan growth, is pushing forward, suggesting that the investment required to outpace inflation is still deemed worthwhile. Meanwhile, the real estate market is in a “digestive” phase, with growth slowing to a fraction of its post-pandemic speed.

As we move further into 2026, the critical question remains whether the corporate borrowing is being used for productive expansion or simply to bridge the gap in a high-inflation environment. The answer will determine the long-term health and trajectory of the U.S. economy, especially as the market anticipates the Federal Reserve’s expected rate cuts later in the year.