U.S. stock futures moved lower early Monday as investors turned cautious ahead of a key week packed with a Federal Reserve policy decision and major technology earnings.

Futures tied to the Dow Jones, S&P 500, and Nasdaq all pointed to a weaker open, reflecting nervous sentiment after recent market volatility. Traders are holding back as they wait for clarity from the Federal Reserve on interest rates and future policy signals.

At the same time, gold prices surged to a fresh all-time high, signaling strong demand for safe-haven assets. The rally in gold suggests investors are hedging against economic uncertainty, market swings, and possible changes in monetary policy.

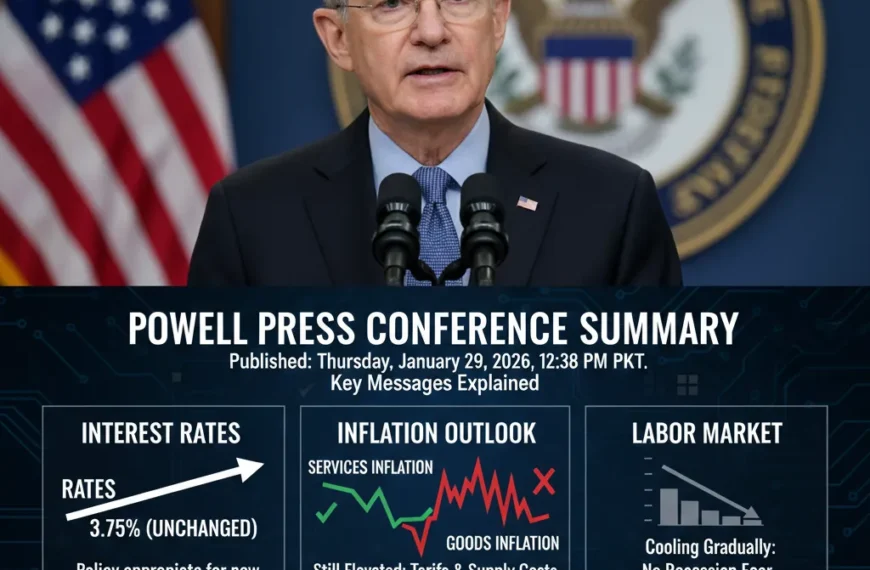

Markets widely expect the Fed to keep interest rates unchanged at this meeting. However, investors will closely watch the Fed’s statement and Chair Jerome Powell’s comments for hints on when rate cuts could begin later this year.

Adding to the tension, several major technology companies are set to report earnings this week. Results and forward guidance from big tech firms could heavily influence market direction, especially after recent gains in the sector.

With central bank decisions, earnings reports, and broader economic concerns all colliding this week, investors appear to be taking a defensive stance. Until clearer signals emerge, markets may remain sensitive to even small policy or earnings surprises.