The latest Federal Reserve H.8 statistical release, published on January 23, 2026, reveals a significant milestone for the American banking sector.Total deposits at commercial banks have climbed to $18.6 trillion as of mid-January 2026. This upward trend highlights a notable shift in saver behavior, driven by a search for higher yields in a changing interest rate environment.

Deposits Hit Record Levels

According to seasonally adjusted data for the week ending January 14, 2026, total deposits at commercial banks in the United States reached approximately $18,622.7 billion. This represents a steady climb from the $17,825.6 billion recorded in December 2024.

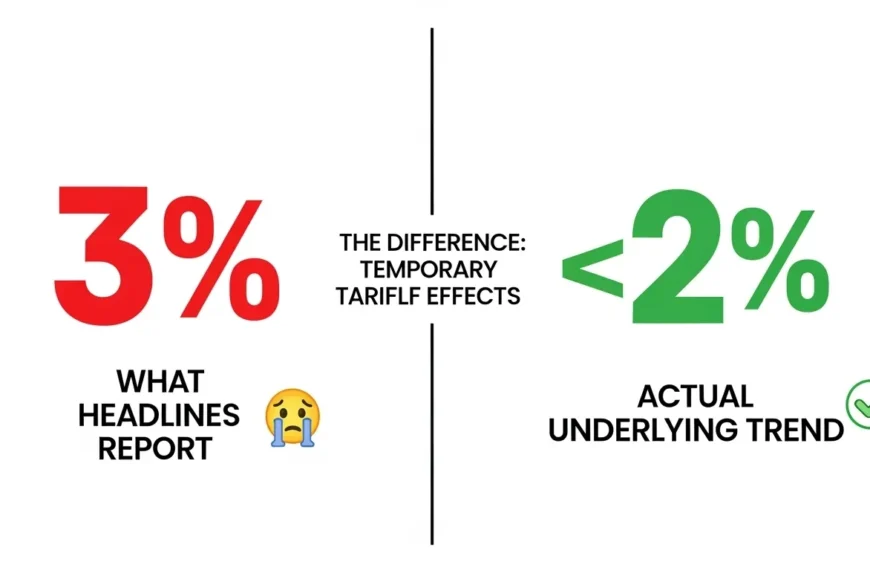

The growth marks a continued recovery; the annual rate of change for deposits in 2025 was 3.8%, a significant rebound from the negative growth seen in 2022 and 2023.

The Great Migration to Time Deposits

The most striking detail in the Fed report is the aggressive movement toward Large Time Deposits (certificates of deposit usually over $100,000).

- Growth Surge: Large time deposits saw a staggering 38.1% annual growth rate in 2023.

- Steady Gains: This category grew by 6.7% in 2024 and maintained a 2.4% rate through 2025.

- Current Volume: By January 14, 2026, these accounts reached a volume of $2,439.5 billion.

- Saver Behavior: This shift indicates that savers and institutional investors are increasingly locking funds into time-bound accounts to capture higher interest rates.

Domestically Chartered vs. Foreign Banks

The appetite for deposits remains strong across different types of institutions:

- Large Domestically Chartered Banks: The top 25 banks hold the majority of liquidity, totaling $11,603.0 billion in deposits as of January 14.

- Small Domestically Chartered Banks: Community and regional banks saw their deposits rise to $5,640.7 billion.

- Foreign-Related Institutions: Deposits at U.S. branches and agencies of foreign banks stood at $1,379.0 billion.

Why It Matters for the Market

For investors and savers, this data confirms that “lazy money” is exiting standard checking accounts. While $16.1 trillion still sits in “Other Deposits” (standard savings and money market accounts), the momentum is clearly moving toward fixed-term yields.

As banks compete for liquidity to fund their loan books—which grew 5.4% in 2025—the shift toward time deposits suggests consumers are prioritizing guaranteed returns over immediate liquidity.