The financial world often hangs on every word from Federal Reserve Chair Jerome Powell. But for most of us, deciphering his speeches can feel like trying to understand an ancient language. If you’ve been wondering what the Fed’s latest signals mean for your wallet, you’ve come to the right place.

We’ve translated the recent Fed updates into plain English so you can understand the key takeaways and how they might affect your money, from mortgage rates to savings accounts.

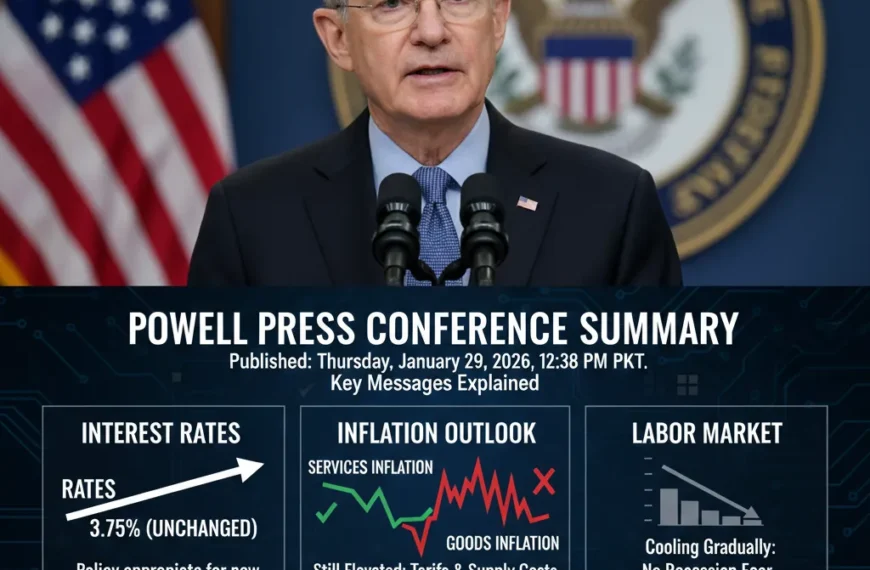

1. The Big News: The “Pause” on Rate Cuts is Here

The most significant signal from Powell is that the Federal Reserve is likely hitting the brakes on interest rate cuts for now. After a series of cuts in late 2023, Powell indicated that the Fed will likely keep rates steady at their upcoming meeting.

What Powell Said (in Fed-speak): “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

What It Really Means: “We’ve lowered borrowing costs enough for the moment. Our plan is to wait and closely watch if prices truly stabilize before we consider making borrowing any cheaper again.”

This essentially means don’t expect a sudden drop in loan rates or an immediate surge in economic activity driven by cheaper money.

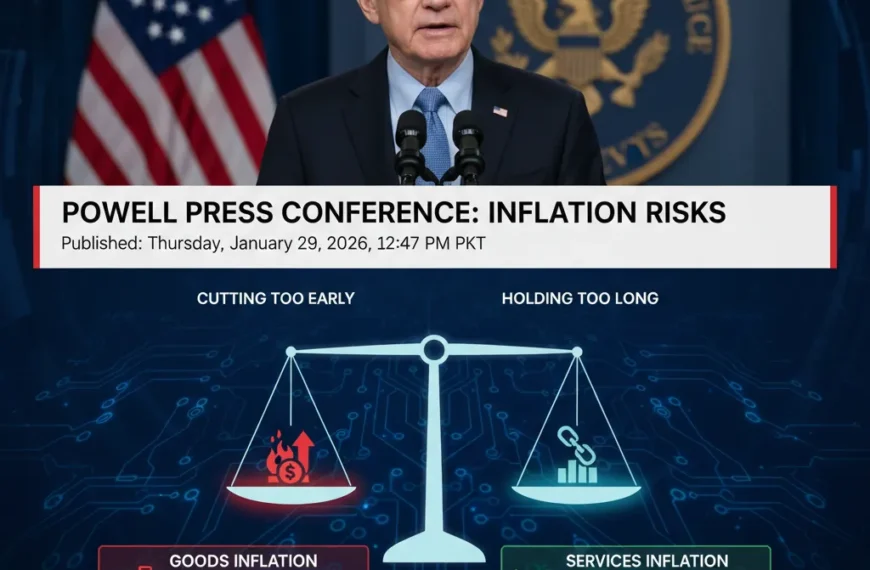

2. Inflation: Still a Little “Sticky”

While inflation has significantly cooled from its peak, Powell noted that it hasn’t quite reached the Fed’s ideal 2% target yet. It’s currently hovering closer to 2.8% (based on the Fed’s preferred Core PCE data).

A Key Line from Powell: He suggested that “inflation progress has stalled” recently.

What This Means for You: This isn’t a signal for prices to drop overnight. The Fed is cautiously optimistic but fears that if they cut rates too quickly, inflation could “rebound,” sending costs back up for everyday goods and services. So, while things aren’t getting rapidly more expensive, don’t expect massive price cuts at the grocery store just yet.

3. The Job Market: Steady, But Not Soaring

The U.S. labor market is in an interesting phase. We’re not seeing widespread layoffs, which is good news. However, companies also aren’t hiring new staff at a rapid pace. Powell described the labor market as stable but with “stagnant” growth.

The Fed’s Ultimate Goal: The central bank is aiming for what economists call a “Soft Landing.” This means slowing down the economy just enough to bring inflation under control without triggering a major recession that would lead to widespread job losses. It’s a tricky balancing act!

4. Standing Firm: Defending the Fed’s Independence

In a noteworthy move, Powell recently released a video message directly addressing and defending the independence of the Federal Reserve. This was a clear response to increasing political pressure for the Fed to lower interest rates more aggressively.

Translation: “Our decisions are driven by economic data and our mandate, not by political timelines or demands. We need to be free from short-term political influence to do our job effectively for the long-term health of the economy.”

What Does This All Mean for Your Wallet?

Here’s a quick glance at how the Fed’s current stance might impact your personal finances:

| Category | What Powell Signaled | Impact on You |

| Mortgages & Loans | Rates likely to stay flat for now | If you’re looking to buy a home or take out a new loan, don’t expect a significant drop in interest rates in the immediate future. |

| Savings Accounts | High yields are sticking around | Good news for savers! Your high-yield savings accounts and CDs should continue to offer attractive interest rates for a bit longer. |

| Credit Cards | No immediate relief on interest | Interest rates on credit card debt will remain high since the Fed isn’t signaling cuts. Prioritizing debt repayment is key. |

| Stock Market | Continued Uncertainty/Volatility | Markets often react to “stalled” progress. Expect some fluctuations as investors digest the Fed’s cautious approach. |

Understanding Jerome Powell’s message is crucial for making informed financial decisions. While the full impact unfolds over time, the current outlook suggests a period of stability in interest rates, continued vigilance on inflation, and a careful eye on the job market.

What are your thoughts on the Fed’s latest signals? Share in the comments below!