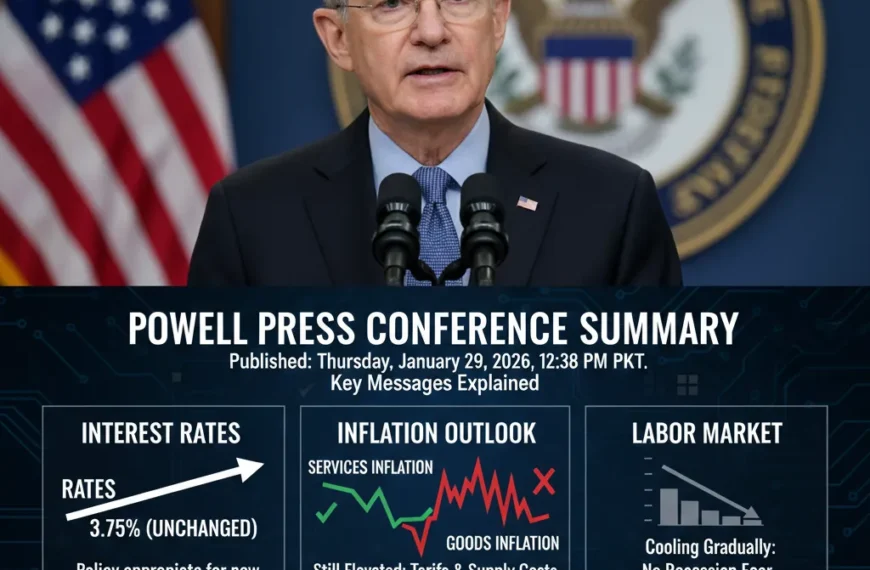

The Federal Reserve kept interest rates steady at its January 28, 2026, meeting, maintaining the federal funds rate at 3.50% to 3.75%. During the post-meeting press conference, Fed Chair Jerome Powell emphasized that “upside risks to inflation” remain a primary concern, driven largely by new tariff pressures on goods. This shift in tone signals that the central bank has entered an extended pause as it balances the need to stabilize prices against a cooling labor market.

Powell’s Overall View on Inflation

Powell noted significant progress since the 2022 inflation peak but acknowledged that reaching the 2% target remains a challenge. Current data shows Core PCE at 3.0% for December 2025, which Powell described as “somewhat elevated.”

The Chair gave a cautious assessment, stating that while the economy is expanding at a “solid pace,” the Fed is not yet ready to declare victory. He indicated that the “last mile” of disinflation is being complicated by external trade factors.

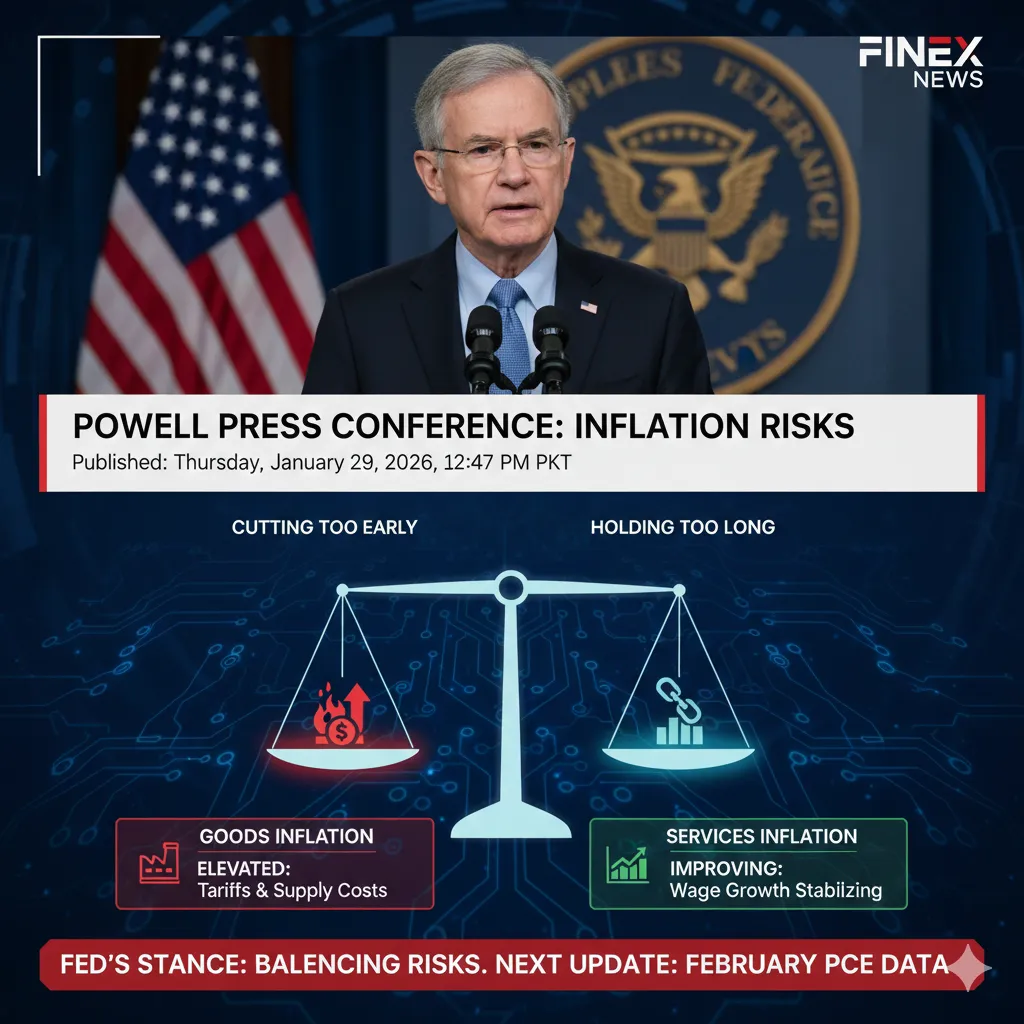

The Two Inflation Risks Powell Highlighted

Powell described the Fed’s current task as managing a delicate balance between two types of risk:

- Risk of cutting rates too early: This could cause inflation to become “entrenched” above the target, forcing the Fed to hike rates later and damaging its credibility.

- Risk of keeping policy tight for too long: This could lead to unnecessary “fraying” in the labor market and potentially trigger a recession.

Powell stated that these risks have become “better balanced,” allowing the Fed to adopt a “wait-and-see” approach for the first half of 2026.

Inflation Risks According to Powell

| Risk Type | Powell’s View | Why It Matters |

| Cutting too early | Could revive inflation | Loss of Fed credibility |

| Holding too long | Could slow growth | Job market stress |

| Goods inflation | Still elevated | Delays overall disinflation |

| Services inflation | Improving | Supports current patience |

Goods Inflation as a Key Concern

A central theme of the briefing was the resurgence of goods inflation. Powell explicitly linked this to tariffs, noting that companies are “strongly committed” to passing these costs through to consumers.

He explained that while the Fed hopes these are “one-time” price hits, they make the inflation outlook “murky.” Because these costs are driven by trade policy rather than consumer demand, traditional interest rate tools are less effective at controlling them.

Services Inflation and Disinflation Progress

While goods remain a concern, Powell pointed to services inflation as a bright spot. This sector, which includes rent and insurance, is showing a clear “disinflation trend.”

Powell observed that labor market rebalancing has helped moderate wage growth toward levels consistent with price stability. The cooling of the services sector provides the “green light” for the Fed to hold rates steady rather than considering further hikes.

Inflation Expectations and Fed Confidence

The Fed monitors how the public expects prices to move in the future to ensure stability.

- Near-term: Expectations have fluctuated but are generally trending lower.

- Long-term: Powell reported that long-term inflation expectations remain “well-anchored” at the 2% goal.

This stability in expectations gives the Fed the flexibility to be patient with its policy decisions without fearing a wage-price spiral.

How Inflation Risks Shape Fed Policy

Because of these balanced risks, the Fed is not committing to a preset schedule for rate moves. Powell reiterated that the FOMC will follow a “meeting-by-meeting” approach.

This strategy means the Fed will let the “data light the way.” If inflation falls faster than expected, a cut in June remains possible; however, if goods inflation stays high, rates will likely remain at 3.75% for much of the year.

Market Response to Powell’s Inflation Remarks

| Market | Reaction | Interpretation |

| Bonds | Stable yields | No policy surprise expected |

| Dollar | Rose slightly | “Higher for longer” sentiment |

| Stocks | Mixed | Cautious about growth |

| Rate futures | Repriced | Cuts seen as non-urgent |

What Data Could Change the Inflation Risk Outlook

The Fed is closely watching three specific areas as it prepares for the mid-March meeting:

- PCE Inflation Trends: The next release on February 20 will show if the December spike was temporary.

- CPI Confirmation: February 11 data will provide an early signal of 2026 price trends.

- Jobs and Wage Data: The Fed will watch for unseasonably low layoffs or any signs of further “softening” in the job market.

The Federal Reserve is currently prioritizing vigilance. While the U.S. economy remains on “solid ground,” the lingering risks from trade policy and sticky goods prices mean the Fed is in no rush to move. As Chair Powell noted, the goal is to reach the 2% target without causing unnecessary damage to the labor market, a task that requires continued patience.