The Federal Reserve kept interest rates steady at its latest Federal Open Market Committee (FOMC) meeting on Wednesday, January 28, 2026. Fed Chair Jerome Powell highlighted that while services inflation is easing, the cost of physical goods remains a significant hurdle to reaching the bank’s 2% inflation target. This persistent “goods inflation” has forced the Fed to pause its recent cycle of rate cuts as it assesses the impact of new trade policies.

Chair Powell noted that the economy is expanding at a “solid pace,” but high goods prices are keeping the Personal Consumption Expenditures (PCE) price index elevated. This development is crucial because it directly influences how long borrowing costs will remain high for consumers and businesses.

What Is Goods Inflation?

Goods inflation refers to the increase in prices for tangible, physical products that consumers buy. Unlike services, which involve labor and expertise, goods have supply chains, raw material costs, and shipping requirements.

Examples of items in this category include:

- Durables: Vehicles, appliances, and electronics.

- Nondurables: Clothing, food, and household supplies.

While services inflation (like rent or insurance) has started to cool, goods inflation has recently moved in the opposite direction, creating a “mixed” inflation landscape for the Fed.

What Powell Said About Goods Inflation

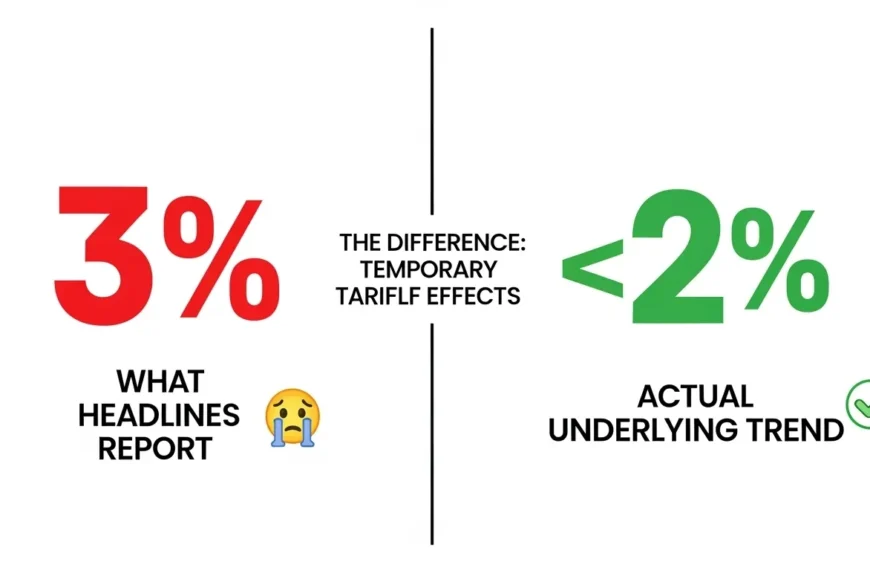

In his January 28 press conference, Powell stated that the recent “overshoot” in core PCE inflation—which likely hit 3.0% in December 2025—is largely driven by the goods sector. He explained that while services are showing a “disinflation trend,” goods have been “boosted by the effects of tariffs.”

Powell emphasized that the Fed sees this as a specific challenge, though he expressed hope that these increases might be “one-time” price adjustments rather than a permanent trend.

Comparison: Goods Inflation vs. Services Inflation

| Category | Goods Inflation | Services Inflation |

| What it includes | Physical products (cars, food) | Non-physical (rent, medical) |

| Recent trend | Elevated / Rising | Gradually easing |

| Key drivers | Tariffs, supply costs | Wages, labor demand |

| Sensitivity to rates | Lower, slower response | Higher impact over time |

| Fed’s current view | Ongoing concern | Improving |

The Role of Tariffs in Goods Inflation

A primary reason for the Fed’s concern is the direct impact of import tariffs on goods prices. Tariffs act as a tax on imported materials and finished products, which businesses often pass on to consumers to protect their profit margins.

Powell specifically referenced these tariff effects, noting that they make inflation “sticky” in the goods sector. Because tariffs are a result of trade policy rather than consumer demand, they are more difficult for the Fed to control using traditional interest rate hikes or cuts.

Why Goods Inflation Worries the Fed

The Fed monitors goods inflation closely for three main reasons:

- Headline Impact: It accounts for a large portion of the total PCE index.

- Slowing Disinflation: If goods prices keep rising, they offset the progress made in the services sector, slowing the overall decline of inflation.

- Expectations: If consumers see physical prices rising constantly, they may expect higher inflation in the long term, which can lead to further price hikes across the economy.

How Goods Inflation Influences Fed Policy

The persistence of goods inflation is the main reason the Fed did not cut rates in January. It supports a “wait and see” approach, as the committee wants to observe if these price spikes are temporary or if they will require higher rates for a longer period.

The Fed will continue making decisions on a meeting-by-meeting basis. If goods inflation does not subside, the timeline for the next interest rate cut will likely be pushed further into 2026.

Key Data Tracking Goods Inflation

| Data Release | What It Measures | Why It Matters |

| PCE Goods Inflation | Consumer goods prices | Fed’s preferred gauge |

| CPI Goods Index | Retail goods inflation | Confirms broader price trends |

| Import Prices | Cost of imported goods | Tracks tariff and trade impact |

| Producer Prices | Upstream manufacturing costs | Signals future retail prices |

Market Reaction to Goods Inflation Concerns

The bond market responded to the Fed’s cautious tone with stable yields, as investors lowered their expectations for a March rate cut. The U.S. Dollar strengthened following Powell’s comments, reflecting the reality that U.S. rates will likely remain higher than those in Europe or Asia for the near future. Risk assets, like stocks, showed mixed results as investors weighed strong growth against higher costs.

What Would Ease Goods Inflation

Several factors could help bring goods prices down:

- Lower Trade Costs: A reduction or stabilization of global tariffs.

- Supply Chain Normalization: More efficient movement of goods from factories to stores.

- Softer Consumer Demand: If people buy fewer physical products, businesses may be forced to lower prices to attract customers.

The Federal Reserve remains cautious because goods inflation is preventing a clean return to its 2% target. While the services sector is improving, the impact of tariffs and trade costs on physical products remains a “tension” in the Fed’s dual mandate of price stability and full employment. For now, patience remains the Fed’s primary strategy as it waits for the next round of data in February.